Five years ago, Snapchat was the hottest thing around, more popular among users than social media kins Facebook and Instagram.

These days? Not, so much.

For one, since last year’s IPO—then labeled “one of biggest Wall Street flops“—the stock’s been dropping like crazy.

Since February, around the time a single Kylie Jenner tweet wiped out $1.3B in company value, Snap has dropped from a public valuation of $24B to $14B.

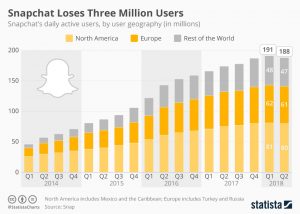

And get this: According to its Q2 report, Snap users are dropping like flies. Since Q1, a whopping 3M users have ditched Snap—the first time user count has dropped quarter-over-quarter in the company’s history.

And yes, Facebook has taken some legal hits lately, but Snap could be facing a battle much bigger.

If you can’t buy ’em, steal ’em (their users, that is)

While users are dropping en masse, Snap still sports a robust 188M daily user base. But competition from rivals is getting more intense by the day.

Facebook—who actually tried to buy Snap for $3B in 2013—saw its user base increase to 1.47 billion over the same period.

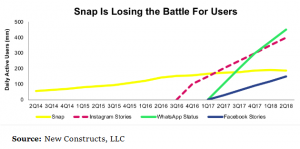

And powered in large part by their Snapchat story clone Instagram Stories, Instagram has grown to 400M users—more than double Snap’s user count.

Oh, it gets worse.

WhatsApp, another Facebook property, has their own version of Snapchat’s major value prop (WhatsApp Status), leaving you wondering exactly what Snap has to offer.

Users could be wondering the same.

For whatever it’s worth, while Snap’s user count has eroded, WhatsApp has seen a healthy spike in active users, peaking at nearly 450M.

Facebook Stories (at this stage, you get the point) boasts of over 150M users, as well.

When the decline began…

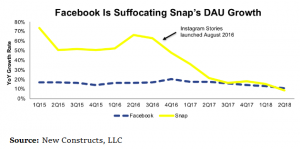

In the chart, we can see that Snap’s user growth has been severely impacted post the release of Instagram Stories two years ago. While Snap’s daily active users (DAU) rose 48% year-over-year in 2016, it fell to 18% towards the end of 2017. An extremely telling blow.

But it’s not just Zuckerberg…

From a business model standpoint, Snap is similar to the other internet blue-chippers (think Facebook, Google, Twitter, etc.). Their revenue is pretty much all advertising income; a total of 97% in 2017.

But that’s pretty much where the comparison ends. Unlike the other tech giants, Snap must be thinking they’re Big Meech or Larry Hoover, because they are blowing money fast.

Compared to Facebook, Twitter and Google—which have gross margins of 85%, 67%, and 57%, respectively—Snap has a paltry gross margin of 20%.

No way?

Yes way. Snap’s expected to continue to post negative margins in the short term. And they will need to figure out how to boost their average revenue per user (ARPU) substantially if they even want to think about being profitable.

Initially billed as the new Facebook, Snap has pretty much struggled to keep up according to every relevant metric since its IPO.

Facebook, on the other hand? Sure, they had a rough start when they debuted on Wall Street in 2012. But since then, Facebook’s enjoying healthy profits, racking in billions of dollars after tax.

And more importantly, Facebook’s market value has 10X’d, jumping from a $50.92B low to $520B as of Aug. 31, 2018. (They’ve been as high as $615B on July 16.)

So what can Snap do?!

Hard to say. It’s not just Facebook that’s kicking Snap’s rear end. They’re also way behind Twitter in terms of profitability.

In order for Snap to catch up with Twitter’s current growth, Snap will have to increase annual revenue by 46%.

Facebook recovered after a rough start, why won’t Snap?

Well, in theory they could. Facebook did, right? And Facebook’s first few years were much worse.

Valid point, yes. But a couple of key points to consider. For one, Facebook was already the most sought-after social media platform when it went public. That wasn’t really the case with Snap.

And secondly, in order to achieve robust revenue growth, Snap will have to gain market share from Facebook—basically steal its users back. And at this point, that looks almost impossible.

But crazier things have happened. Snap away, WealthGANG…

You must be logged in to post a comment Login