Cybersecurity stocks are lit this year.

Just as a point of reference, one cybersecurity ETF alone [HACK] is up over 26% in 2018.

You remember the ETFs, right? It’s the investment funds that pick up a type of stock (like tech or REITs), diversify their holdings across that sector, with the idea of giving you nice, solid, stable returns.

Anyway, why are cybersecurities hot?

Pretty simple. As Facebook told the White House a month ago, we’re in a “cybersecurity crisis.”

So basically, as cyber threats continue to increase, so does enterprises spending on cybersecurity.

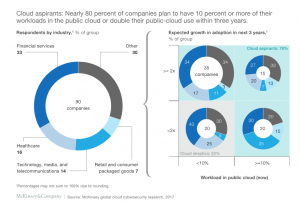

According to McKinsey, almost 80% of companies plan to move 10% or more of their business to the cloud.

So obviously, this mass migration towards the cloud forces increased network security services.

But one in cybersecurity stock, in particular, is straight fire. One of the top cybersecurity companies, Proofpoint [PFPT] has exploded from $4.16B in early January to $6.08B to date.

And the way things are trending, this stock could go even higher. Let’s break it down.

Cybersecurity is growing as a whole

The worldwide security appliance revenue rose 14.3% year-over-year to $3.24B in the first quarter of 2018.

Moreover, the global cybersecurity market is expected to experience serious growth; revenues are expected to explode from $153B in 2018 to $232B in 2022.

Here’s CNBC’s stock expert Jim Cramer breaking down his favorite cybersecurity stocks.

Growth spurt: From $905M to $6B

Proofpoint provides cloud-based security solutions and services, ranging from email protection, ATP (advanced threat protection), data loss prevention, email authentication, secure communication just to name a few.

Shares of Proofpoint have increased over 8x from $14.08 in April 2012 to $119.8 in August 2018, powered by growth in revenue and earnings.

In raw market value, that’s a jump from under $1B in value to more than $6B, as mentioned before. (Sick.)

Revenue’s up 5X

Proofpoint’s revenue has grown from $106M in fiscal year 2012 to $515M as of ’17.

And get this: Analysts expect revenue to continue to climb to $708M in 2018, $906M in 2019 and $1.15B in 2020.

(The cybersecurity crisis must be real!)

Proofpoint’s revenue-driving strategy has historically been focused on new products, acquisitions and partnerships.

(Proofpoint acquired Wombat Security in February 2018. Which followed a 2017 acquisition of Cloudmark, a company specializing in security for messaging services. And Weblife.io, a leader in browser isolation solutions. And…you get the point.)

This strategy—coupled with a high customer renewal rate of over 90%—indicates robust product portfolio and a high customer satisfaction rate.

Still not profitable (but who cares?)

Similar to several other tech companies, Proofpoint is still reporting losses.

That said, Proofpoint’s net margin is expected to improve from -16.8% in 2018 to -10.3% in 2020. As the company continues to gain market share, investors likely won’t care too much either.

The Cali-based company continues to allocate significant resources towards sales and marketing—something analysts expect will impact profit margins in the short-term.

The threats…

There is also a threat of competition from heavyweights like Cisco [CSCO] and other niche players including Palo Alto Networks [PANW], Symantec [SYMC], Fortinet [FTNT] and FireEye [FEYE].

Proofpoint’s shares fell from $127.7 to $112.7 in July after quarterly results were released. Analysts were not too buoyed by the firm’s revenue forecast, which resulted in a sell-off (and thus a drop in the price).

Still all good, though!

All in all, Proofpoint shares have risen 35% in 2018.

The stock seems to have recovered from the Q2 hiccup, too. It rose over 4% on Aug. 24.

That said, the stock is still trading at a discount to its low analyst price target of $125. What does that mean in layman’s terms?

Over 90% of analysts recommend a “buy” on the stock with an average price target of $139.67—plenty of juice left to make a score for the year.

Have at it, WealthLABBERs…

*Opens Robinhood…*

You must be logged in to post a comment Login