Real Estate Investing

ANALYSIS: Top Real Estate Crowdfunding Platform Just Collapsed. What Does This Mean For The Industry?

Published

7 years agoon

RealtyShares, a San Francisco-based startup, is a real estate crowdfunding platform that offers debt and equity investments for apartment buildings, office buildings, malls and so on.

As recent as August, this crowdfunding company was named a “hot startup” by Inc. Magazine.

Since its 2013 inception, Realtyshares says it’s raised more than $870M for more than 1,160 real estate projects. Investors far and wide, left and right, were pouring money into the platform.

Had investors like…

And now, in November?

The very same startup announced it has stopped taking new investments, that it’s laying off most of its employees.

Why? Because they were unable to secure more operating capital.

The easy story to tell here is that real estate crowdfunding—an industry disruptor democratizing access to institutional real estate assets—is little more than fad—much like the whispers around crypto.

(Which is taking a f*cking beating, btw. They’re even calling it a #fraud.)

Sure, it’s an easy, simplistic conclusion to draw. But there might be a little more to it than that.

What’s the story?

On Sept. 14, 2017, Techcrunch reported that Realtyshares had closed a $28M Series C funding round, bringing their total VC investment amount to $105.6M, per Crunchbase.

At the time, then-CEO Nav Athwal (who since left in November 2017) said they had over 120k users on the platform and wanted to “diversify in real estate in a way that hasn’t been possible before.”

At the time, Tyler Christenson, managing director at Cross Creek Advisors, who led the funding round, was super bullish with the boilerplate and jargon out in full force.

“RealtyShares is positioned to become the leading marketplace for sub-institutional debt and equity commercial real estate investment,” he said.

“These commercial investment opportunities in multifamily, retail, industrial, and office properties have historically been limited to large institutions, and RealtyShares has been able to break down many of the barriers investors have faced.”

Now? No more deals. And mass layoffs ahead.

$870M? $105M? $28M? What does it all mean?!

In 2017, when the round closed, Athwal said they had deployed $500M across deals. As of November, Realtyshares says that number’s $870M—a 74% jump in deal flow.

Now, just for clarity, taking investments for deals on the platforms vs. taking investments operating capital are two entirely different things.

As we’ve covered around here, startups raise capital for the purpose of increasing valuations, offering early investors (who take bigger risk by going in early) juicy exit strategies.

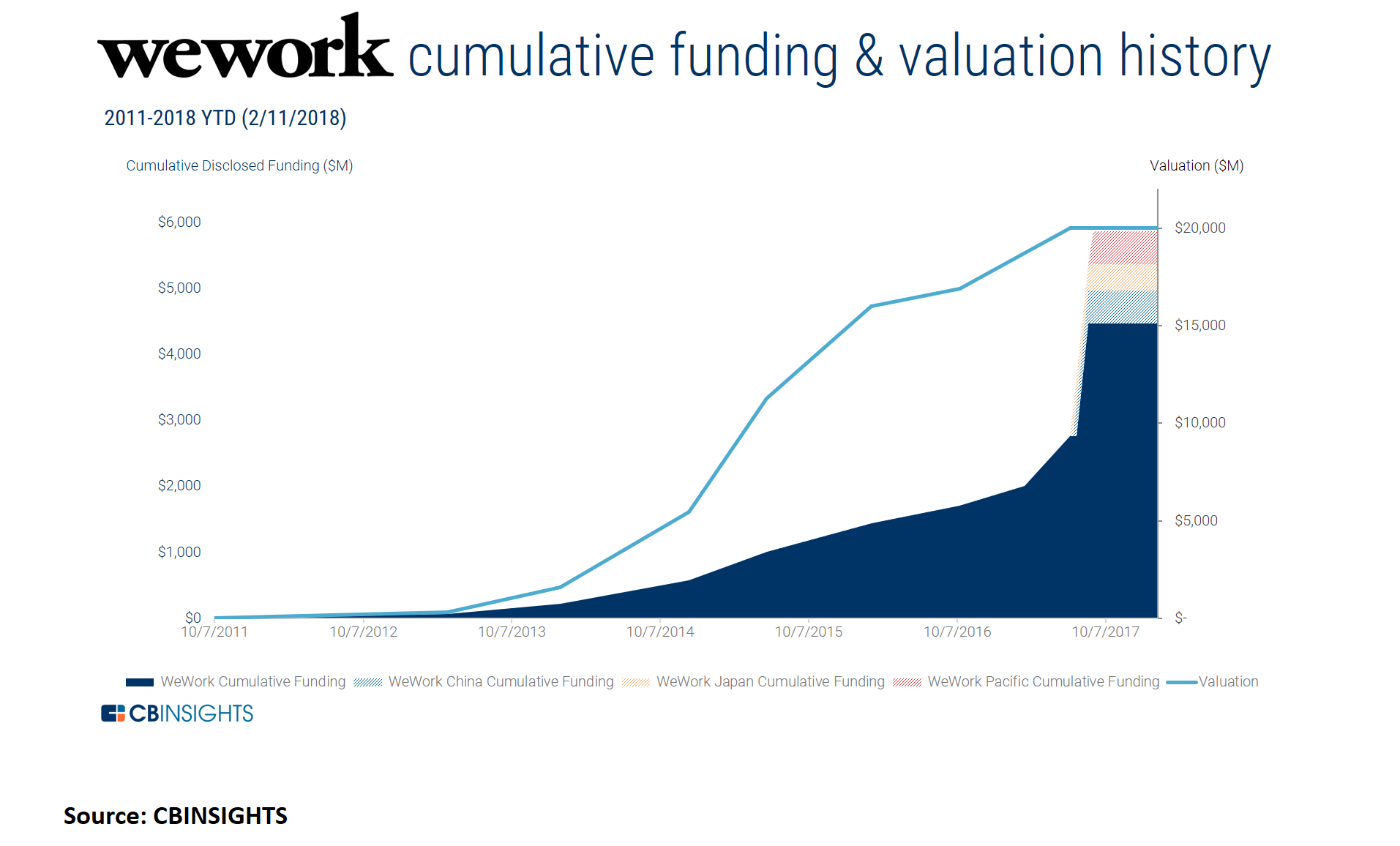

Example. See WeWork, right? It was worth $5B, then $10B, before landing at an insane $20B, with whispers then of being too aggressively valued. Guess what: It’s worth $45B.

Take a look at their funding history—and the valuations that followed.

For Uber, back in 2014, when it was “just” worth $17B, early investors made 2,000x return their initial investment. Four years later, Uber’s now rumored to go public at $120B. You do the math on that one.

How does this tie into Realtyshares?

Good question. Here’s how.

You see, with each funding round—Series A, Series B, Series C (hey, can the WealthLAB finance team get on a “Funding Rounds, Explained” piece soon?!), Series D, etc.—startups hope to increase the valuation of the enterprise.

Then ultimately either go public in an IPO or get sold to a private buyer. This is what early investors, angels, VCs and so on want to see. This is how they get their 10x.

“Over the past six months, RealtyShares aggressively pursued a number of financing options to continue growing the business,” RealtyShares wrote in an email to customers.

According to a report by The Real Deal, a Hail Mary, last-ditch effort to find a buyer failed. With no more capital to raise or valuation jumps to squeeze, Realtyshares said “No Mas.”

“Unfortunately, despite our best efforts, we were unable to secure additional capital. As a result, we will not offer new investments or accept new investors on the RealtyShares platform.”

Sooo, is crowdfunding doomed?

That’s the obvious, quick-trigger question. Does this mean the still-young real estate crowdfunding industry is doomed?

No. Real estate crowdfunding is basically pseudo-private/kinda-sorta public syndication of deals—a practice that’s existed forever.

Deals will continue to get syndicated, money will continue to pool, and this will happen offline, online, in whatever line. It’s one of the hottest asset classes for pension funds to protect against inflation, for instance.

Just look at Blackstone’s recent $18B fund. Those are standard practice.

So where did Realtyshares’ money go?

You got $870M worth of deals. You raised over $105M. Where did the money go?

Important point to underscore: The capital invested into Realtyshares, Inc. is to run and scale the business.

These investors are totally separate from the investors in the real estate offered on the platform. In addition, the $870M is deal volume.

In theory, the deals you invest in on Realtyshares may be for a fraction of the equity in the total deal. Which then is leveraged with debt. (Mortgage. A loan.)

Like, here’s an example: Deal costs $100M. Down payment is $10M. Realtyshares has a $1M equity offering in said deal; 100 investors invested $10k in that deal. Total deal is technically $100M.

Doesn’t mean that Realtyshares actually had $100M between their hands. Their operating cash comes from that $105M+.

The “transition will have no impact on the underlying real estate investments,” Realtyshares said in same note. In other words, for the crowdfunding investors in the assets listed on Realtyshares, it’s business as usual.

Go ahead. Celebrate. Do a lil’ dance. You still got your money.

So why the smoke?

So the $105.6M? Where did it go? Yeah, here comes the bad news…

RealtyShares makes money when investors invest into the real estate deals on their platform.

In essence, Realtyshares snags a commission at the time of the investment and also over time, designed to be lower than the industry average.

Hence the disruption.

So, most likely, Realtyshares—whose disruptive business model offered investment access at lower fees than its private equity and asset management competitors, just to reiterate—found it couldn’t sustain the growth with its current business model.

When companies plateau…

This is obviously speculation on our behalf, but let’s use this entirely hypothetical example as an illustration.

You have a business that charges a $10 commission of each sale of hardware. Based on the market size, you can reasonably expect to do 100,000 sales every year.

Total market is 1M sales a year. In theory, you have another 90% of the market to get a piece of. But in reality, your plateau comes at 125k sales every year.

Your ceiling, in other words, is $1.25M in revenue every year.

Now, if you’ve raised money with the intention of increasing the value—again, this is a general example, not specific to Realtyshares—and you hit a ceiling in terms of revenue…

There’s only so much upside to justify a valuation to investors before they say…

Is that what happened here?

Who knows? Could be. Looks like it.

It’s what happen to a lot of them. They raise tons of cash, accelerate the growth, grow too fast, and then they die.

In fact, “premature scaling” at one point was (and still may be) the No. 1 startup killer. This basically means when a company grows too fast for its own good,

In fact, premature scaling causes the death of 74% of tech startups.

Or as internet entrepreneur and New York Times bestseller Neil Patel put it:

If you gain more funding than your business warrants at its specific stage, it can produce undesirable side effects. In essence, it can cause you to expand your operations beyond what is manageable. This is premature scaling in its most common and nefarious form, and it is going to destroy your startup.

Back to real estate crowdfunding.

So what’s the rest of the industry saying? Why the sudden Realtyshares collapse?

CEO of Crowdstreet Tore Steen says the Realtyshares situation isn’t an indicator of health or longevity in the industry.

“It’s actually an indicator that the industry is maturing,” Steen says. “In an industry like this—crowdfunding of commercial real estate—you’re going to have certain business models that survive and certain ones that might not.”

Co-founder of competitor EquityMultiple Charles Clinton agreed, saying head count is to blame.

“I think you’ve seen some of the platforms that have managed headcount and spending a bit more judiciously are maybe a bit better situated for the next couple of years of growth,” Clinton told NREI.

And in the meantime?

It’ll create a “temporary crisis for people,” but that the industry will get past this pretty easily, Clinton said. “We’re still in the very early innings of total growth.”

You may like

Real Estate Investing

5 Recession-Proof Investments for Your Portfolio

Published

3 years agoon

May 3, 2023

By Sheryl Chapman

As we all know, the economy can be unpredictable at times. Recession is a common phenomenon that can affect the investments in your portfolio.

But don’t worry, there are some sectors that are likely to perform well—even during a recession. Here are five recession-proof investments that you can consider adding to your portfolio.

(Editor’s note***********:************ If you wanna learn how to start investing for retirement, check out the free lessons inside the academy! 📺)*

1. Consumer staples

Consumer staples are products that are essential to our daily lives, such as food, household goods, and personal care items.

These products are in constant demand, regardless of the economic climate. Companies that produce these items, such as Procter & Gamble and Coca-Cola, are considered recession-proof investments.

These companies have a stable revenue stream that can weather economic downturns.

2. Utilities

Utilities are another recession-resistant investment. People need electricity, gas, and water, regardless of the state of the economy.

Utility companies, such as Duke Energy and American Electric Power, have a steady stream of revenue and provide investors with a reliable source of income.

3. Healthcare

The healthcare industry is recession-proof because it provides essential services that people cannot do without. Companies that provide healthcare services or products, such as Johnson & Johnson and UnitedHealth Group, are likely to remain profitable during a recession.

4. Gold

Gold is a safe-haven investment that many investors turn to during times of economic uncertainty. Gold prices tend to rise during recessions because it is seen as a store of value. Investors can buy physical gold, gold ETFs, or invest in gold mining stocks.

GUIDE: 3 Ways To Invest In Gold In 3 Minutes Or Less 🔑📲

5. Treasury bonds

Treasury bonds are considered to be one of the safest investments during a recession.

These bonds are issued by the US government and are backed by the full faith and credit of the government. Treasury bonds provide a fixed income and are considered to be a low-risk investment.

In conclusion, these five investments are considered to be recession-proof because they provide essential products or services that people cannot do without.

Adding these investments to your portfolio can provide stability during times of economic uncertainty.

Real Estate Investing

5 Tips To Pricing Your Airbnb Listing For Maximum Profits

Published

3 years agoon

May 2, 2023

Airbnb has revolutionized the travel industry by providing an affordable and unique way for travelers to experience different destinations.

With over 7 million listings worldwide, it’s safe to say that Airbnb has become one of the most popular ways for travelers to find lodging.

However, as a host, one of the most challenging decisions you’ll face is determining the right price for your listing.

Pricing your Airbnb listing correctly is critical to your success as a host, as it can make or break your profitability.

Here are some tips to help you price your Airbnb listing for maximum profit:

Know Your Market

Before you set your price, it’s essential to research the market in your area. Look at other listings in your neighborhood, paying attention to the size of the property, amenities, and location. Check the availability of your competitors and the average price they charge. This information will help you determine your pricing strategy and ensure that your listing is competitive.

Consider Seasonal Demand

Seasonal demand plays a significant role in the pricing of your Airbnb listing. During peak seasons, such as holidays, festivals, and major events, you can charge higher rates. Conversely, during low seasons, you’ll need to lower your prices to attract guests. Keep track of events happening in your area and adjust your prices accordingly.

Offer Discounts

Offering discounts is an effective way to attract guests and increase your occupancy rate. Consider offering discounts for extended stays, early bookings, or last-minute reservations. You can also offer discounts to guests who leave a positive review or refer new guests to your listing.

Calculate Your Costs

To ensure that your pricing strategy is profitable, you need to calculate your costs. Take into account expenses such as cleaning fees, utilities, maintenance, and taxes. Factor in your time and effort as well. Your goal is to set a price that will cover all your costs while still allowing you to make a profit.

Be Flexible

Finally, be flexible with your pricing strategy. Test different prices and see how they affect your occupancy rate and profitability. Monitor your competition regularly and adjust your prices accordingly. Remember that the market is constantly changing, and your pricing strategy needs to adapt to stay competitive.

In conclusion, pricing your Airbnb listing for maximum profit is a crucial aspect of your success as a host. By researching your market, considering seasonal demand, offering discounts, calculating your costs, and being flexible, you can set the right price for your listing and maximize your profitability.

Happy hosting!

Real Estate Investing

3 Ways To Turn Your Room Into Money-Making Airbnb Business

Published

3 years agoon

April 28, 2023

Are you looking for a way to earn some extra cash? Have you considered turning your spare room into a money-making Airbnb business?

With just a few simple steps, you can create a cozy and welcoming space that guests will love. In this article, we’ll explore three ways to get started on your journey to becoming an Airbnb host.

Here are three steps to get started TODAY.☕️🏠💰

1. Prepare Your Space: Before you start accepting guests, you need to make sure your space is guest-ready. This means cleaning thoroughly, providing fresh linens and towels, and decluttering the space.

PRO TIP: You may also want to consider adding personal touches like fresh flowers or a welcome basket to make guests feel at home.

Here’s a growth hack from the Airbnb lecture inside the academy: “A nice personal touch like a letter or a note can go a LONG way.”

Oh, by the way…he makes $500K/month from his Airbnb side hustle. (Watch it for free here.)

2. Create Your Listing: Once your space is ready, it’s time to create your Airbnb listing. (Here’s a guide on how to do this in 10 minutes. AND it pays you $25.)

This is where you’ll showcase your space and attract potential guests. Make sure to include high-quality photos, a detailed description of your space and amenities, and accurate pricing information.

You may also want to consider offering discounts for longer stays or adding extra perks like free breakfast or use of a pool.

3. Manage Your Guests: Once your listing is live, you’ll start receiving inquiries and bookings. It’s important to communicate promptly and clearly with guests to ensure a positive experience for everyone.

Make sure to answer any questions they may have and provide detailed check-in instructions.

During their stay, make sure to be available to address any issues that may arise and provide recommendations for local attractions and restaurants.

With these steps, you can turn your spare room into a profitable Airbnb listing and start earning extra income. Happy hosting!

Editor’s Note: If you want a step-by-step coaching session on how to set up your own $100K+ Airbnb side hustle, you can do so here. $49. Limited time only.

Top 5 Best Investment Strategies To Survive A Recession

The Top 10 Investment Opportunities To Capitalize On During A Recession

3 Gold Mining Stocks To Buy Today 📲

Ad 1

Trending

You’ve reached your free article limit.

Continue reading by subscribing.

Already a subsciber? Login >

Go back to Homepage >

You must be logged in to post a comment Login