The IPO market has always been interesting. IPO investors capitalize on high growth companies and might strike a fortune in the long-run if they stay invested in successful companies.

And they’re the ultimate cash-out play for VC investors that came in early. But even getting in early in the IPO stage can be insanely lucrative.

Example.

Facebook [FB] debuted on the stock exchange in May 2012 at $38 per share. The stock reached an all-time high of $218.62 in July this year, providing investors with a return of 475% in just over six years.

But few companies are as successful as Facebook. The social media giant had already reported a net income of $1B in 2010. Last year, the net income rose close to $16B.

That said, the trend this year seen an overwhelmingly large number of private unprofitable company hit Wall Street to major fanfare.

Over 80% of IPOs unprofitable

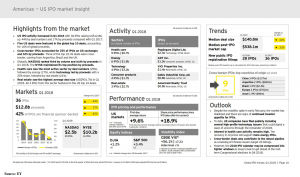

According to this report from the Wall Street Journal, 83% of IPOs listed in the United States in 2018 have lost money in the 12 months leading to their listing.

This number is even higher compared to the dot-com bubble, where 81% of IPO listing firms were unprofitable.

There are some investors like Kevin Landis, the chief investment officer from Firsthand Capital Management, who are wary about investing in loss-making companies. “The lesson from 2000 is don’t chase what everyone else is chasing,” he’s said.

Translation: Don’t believe the hype. But is he right?

These IPOs have generated significant returns

The report highlights that investors have been rewarded for pumping money into loss-making IPOs this year. The stock prices of money-losing firms in the United States have risen by an average of 36% this year.

Surprisingly, this is higher than the average stock returns of 32% for profitable IPOs this year. Compare this with the 10% returns of the S&P 500 ETF [SPY] and you know that the difference is huge.

Exponential returns by IPOs

Investing in companies is not always about profitability. Sure, everyone would like to strike gold by getting an opportunity to invest in a high growth and profitable company like Facebook.

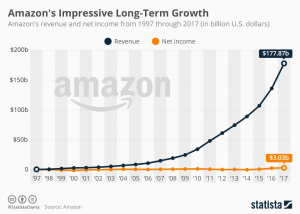

Amazon [AMZN] which is the second largest company as per market cap, reported losses several years post its IPO. Amazon now consistently reports profits after it expanded into other business segments such as Cloud Services.

So what is it that attracts investors to these stocks? Investors are buoyed with the total available market opportunity of certain companies. They value revenue growth over net income and continue to pump in capital.

Investors hope that companies will turn profitable over the long run. Spotify [SPOT] was listed in April 2018. The stock reached an all-time high of $198.99, gaining over 33%. Investors believe the growth in music streaming to drive company revenue over the next few years.

The cannabis market is also estimated to reach $32B in 2020, up from $9.5B in 2017. This has driven the stock price of Tilray Inc. [TLRY] by 550% in less than three months. Eventbrite [EB] had a price and of $21 to $23 per share and the stock rose 60% higher on its first trading day.

Not every bet is successful

There is, however, a serious downside for investors of these companies in case it fails to meet analyst and investor forecasts. Snap [SNAP] has fallen close to 47% this year driven by a declining user growth.

The loss-making IPOs are generally overvalued due to optimistic assumptions and come crashing down if they fail to deliver. GoPro [GPRO] and Fitbit [FIT] are two such companies that have burnt significant investor wealth.

The last time investors were this optimistic about loss-making tech companies, it ended in a horrific bloodbath with the dot-com bubble. Let’s hope Wall Street is proved right this time around.

You must be logged in to post a comment Login