Cannabis stocks are on fire. The United States Marijuana Index gained over 71% in the first few months of 2018. Marijuana has started to gain acceptance, with nearly 30 states in the United States legalizing it in some form.

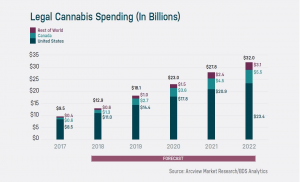

The Canadian government is set to legalize the drug on October 17 this year. With global spending on legal cannabis estimated to reach a whopping $32B in 2020, up from $9.5B in 2017, marijuana stocks are poised to gain big time.

Here are the top cannabis stocks that have performed exceptionally well this year.

1. Canopy Growth

Canopy Growth [CGC] holds the title of being the first publicly traded Cannabis Company in North America. It has an international presence and is also listed on the Toronto Stock Exchange.

The stock was an average performer for the first half of 2018, floating between $25 to $26. But since the first week of August this year, the stock price has seen a surge. It is currently priced at $49.78 as of last week.

Canopy is one of the major players in this space with almost 3.2 million square feet of production capacity. The firm has licensed production sites in 7 out of 10 Canadian provinces. Last year, Constellation [STZ] brands acquired a 9.9% stake in Canopy to develop cannabis-based beverages.

Market Cap: 11.30B

YTD Gain: 126%

Total Gain in $ for 2018: $5.9B

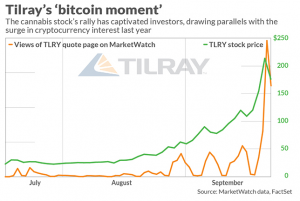

2. Tilray

Tilray [TLRY] was founded early this year, and was listed on the NASDAQ on July 19. The stock has gained 450% since it hit the market, and is currently trading at $123. This is despite a 30% decline on September 21.

Analysts believe Tilray is set to benefit as Canada prepares to open the recreational marijuana market within the next month. It also became the first company to supply cannabis oils and related products in Germany, which will boost overseas revenue as well.

Tilray has a facility in Portugal that will be used as a distribution hub for European countries.

Market Cap: 11.45B

YTD Gain: 450%

Total Gain in $ for 2018: $9.35B

3. Cronos Group

Shares of Cronos Group (CRON) are up over 61% this year. The company recently announced a partnership with Aleafia Health to evaluate if cannabis can be used for the treatment of insomnia and daytime drowsiness.

Cronos recently inked a deal with Ginkgo Bioworks, a partnership that’s expected to bring huge benefits for the medical marijuana industry. Basking under the deal, the company’s stock price has also seen a climb.

Market Cap: 2.17B

YTD Gain: 61%

Total Gain in $ for 2018: $822M

4. MariMed

Shares of the OTC (over the counter) marijuana stock, MariMed [MRMD] have gained a mind-boggling 600% in the last 12 months. This small-cap cannabis stock is both an expert landlord that provides legal and technical know how to growers as well as a producer of premium cannabis products.

It has cannabis facilities in five states across the US, and has expanded its product line over the last year.

Market Cap: 681.35M

YTD Gain: 353%

Total Gain in $ for 2018: $531M

5. Aurora Cannabis

Aurora Cannabis [ACBFF] is another large-cap player in the marijuana market. It is one of the most popular cannabis companies. The company might be listed on a leading US exchange as early as October 2018.

Last week, market chatter highlighted that Aurora Cannabis was in talks with Coca-Cola [KO] to develop cannabis-infused beverages. This drove the stock 18% higher on September 17.

Market Cap: $9.4B

YTD Gain: 32%

Total Gain in $ for 2018: $2.2B

You must be logged in to post a comment Login