Advanced Micro Devices [AMD] has been one of the top performing stocks for quite a while. This chip maker has been a money spinner for investors, gaining over 400% in the last 30 months.

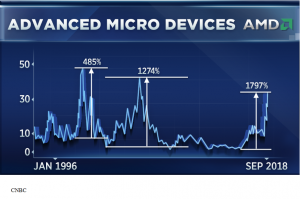

The stock was up a mind-boggling 1850% between Nov. 2015 and Sep. 2018. However, AMD shares have declined close to 40% since the start of Oct. 2018, wiping out significant investor wealth.

So, does this mean AMD’s impressive stock rally has come to an end or is it another opportunity for investors to buy the stock? Despite the recent pullback, AMD is still one of the best performing tech stocks this year.

So why did AMD shares plummet?

AMD has been a Wall Street favorite for a while. So what has been behind AMD’s wild ride in 2018? Chip redesign efforts have benefited the company, driving shares to its 10-year high. The stock rallied close to 300% in the first nine months of 2018 and is now up 85%.

The primary catalyst of the sell-off has been weak third-quarter results for AMD. While sales rose 4% to $1.65B, it was marginally below analyst estimates. AMD forecast revenue of $1.45B for the fourth quarter, which was a bigger miss considering estimates.

The broader tech sell-off witnessed in Oct. also contributed to AMD’s price drop. This coupled with a bear run in the crypto market leading to decreased demand have contributed to a weak earnings forecast.

In our Battle of the Stocks article published in Oct., we had outlined that NVIDIA [NVDA] was a better buy than AMD based on revenue and earnings growth metrics.

Chip revamp drove AMD to 10-year highs

AMD’s management oversaw the redesign of the company’s chip lineup and focused on improved product performance. There were encouraging reviews of AMD’s Ryzen chip for personal computers, Epyc chips for servers and Vega graphics chips.

Initially, sales rose 29% to $5.1B this year while net income rose to $299M, up from a net loss of $14M in the same period last year. However, a large part of this increase in sales was driven by the unsustainable boost in the crypto market.

With the crypto market declining 80%, this demand has also slumped for AMD chips that showed up in the company’s recent quarter. According to AMD, graphics sales in crypto mining accounted for 10% of sales in the third quarter of 2017. Comparatively, the crypto graphics vertical has contributed a negligible amount in Q3 2018.

Intel getting back in line

AMD’s rise in stock price was also driven by Intel’s CEO resignation in June 2018. Intel [INTC] has been struggling to revamp its manufacturing process for a while now. Earlier this year Intel also admitted that its much-awaited 10-nanometer chips will be available in large volumes by the end of 2019.

In fact, Intel’s 10-nanometer chips have been long delayed. The company was slated to launch them back in 2015. AMD’s shares spiraled upwards from $19 to $34 over the next few weeks post Intel’s announcement.

Investors expected this delay by Intel to drive incremental chip sales for AMD. However, Intel has now released information that it would launch chips that will be far ahead of competitor products.

Analysts believe AMD could not quite leverage Intel’s challenges to its benefit. In case Intel’s expected chip products make a strong comeback, AMD’s stock might decline further.

How do analysts view AMD?

The last time AMD’s stock rallied 1300% (between Oct. 02 and Mar. 06), the stock came crashing down and declined 96% over the next two and a half years. Piper Jaffray analyst, Craig Johnson stated, “History may not always repeat, but it does tend to rhyme…….These kind of parabolic advances really only end one way — poorly. From my perspective, I’m not chasing that stock here. I’ll wait for it to come to me.”

Some analysts believe the stock to be overvalued at current prices. It’s currently trading at 58x forward earnings way above the industry average of 14x. The 31 analysts tracking AMD, have an average 12-month price target of $24.17 for the stock. This indicates an upside potential of 27%.

You must be logged in to post a comment Login