Markets this year have been volatile with the trade war fears between United and China looming large for the better part of 2018. The markets have corrected quite a few times this year and more recently on Oct. 10.

Despite an unpredictable global environment, the S&P 500 [SPY] has managed to gain close to 5% this year. The SPY is an index and an indicator of the broader markets. However, there are some stocks that continue to beat market returns.

Here we look at tech stocks that have outperformed markets considerably.

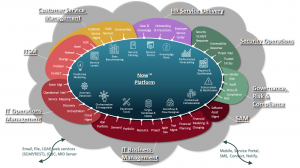

5. ServiceNow

Shares of cloud computing company ServiceNow [NOW] have gained 36% in 2018. This stock is a market favorite and is taking advantage of one of the hottest growth markets in tech ever.

ServiceNow is a profitable, high growth company. Its revenue is expected to grow 34% in fiscal 2018.

Market Cap: $31.5B

Change in 2018: 36%

Total Gain in 2018: $8.5B

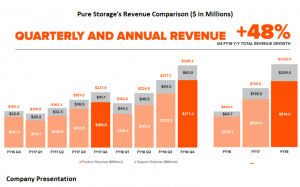

4.Pure Storage

PureStorage [PSTG] is a cloud storage company and has managed to hold its own against heavyweights Western Digital [WDC], Seagate [STX] and NetApp [NTAP]. The stock is up 39% this year.

The stock was trading at all-time high levels last month and it rallied 20% on August 22 driven by impressive fiscal Q2 results. Shares of Pure Storage have generated impressive returns despite the recent pullback in stock price.

Market Cap: $5.2B

Change: 39%

Total Gain: $1.5B

3. Interactive Corp.

Interactive Corp. [IAC] is an internet service company and owns over 150 brands including Tinder and Match.com. IAC has gained 60% this year.

Investment bank Jeffries called this company an “unsung hero of the internet” and expects the stock to have more upward potential. Analysts believe Tinder is still in the early stages of monetization and will be a key revenue driver for IAC.

Market Cap: $16.28B

Change: 60%

Total Gain: $6.1B

2. Fossil

Fossil [FOSL] is fast gaining traction in the global wearable market. The stock is up 140% this year. Fossil is looking to penetrate the smartwatch space. Total smartwatch revenue in Q1 almost doubled and accounted for 20% of total revenue, up from 8% last year.

Fossil also exited product lines and stores that were unprofitable. It, however, competes with Fitbit [FIT], Apple [AAPL], Xiaomi, Samsung, Garmin [GRMN] and Huawei in the wearable space and will need to focus on product innovation to drive market share.

Market Cap: $921M

Change: 140%

Total Gain: $400M

1. Advanced Micro Devices

Advanced Micro Devices [AMD] continues to stun the market. This semiconductor stock is up 130% in 2018. This stock has generated mind-boggling returns of 1000% since the start of February 2016.

AMD has targeted high growth segments such as gaming and crypto mining to drive revenue. Argus analyst raised price target on AMD shares from $23 to $40, while Rosenblatt Securities also raised the target to $40 from $30.

These upgrades drove AMD’s stock higher by 8% on September 14. However, New Street Research does not see any more upside potential in the stock and expects the stock to drop to $18.

Market Cap: $23B

Change: 130%

Total Gain: $13B

You must be logged in to post a comment Login