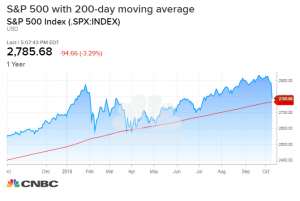

The stock market witnessed a vicious sell-off yesterday. The Dow Jones Industrial Average [DJI] plunged 832 points, with technology stocks at the forefront of this correction.

The Invesco QQQ ETF [QQQ] fell 4.4% while the Technology Select Sector SPDR ETF [XLK] declined 4.9%. The sell-off was similar to the one witnessed earlier this year in February.

However, Jamie Cox from Harris Financial Group is not too concerned. Cox stated, “This was way different than February and March. In February, everything got shellacked. Even banks didn’t get hit that bad today. It wasn’t what you’d expect in a full-blown washout sell-out. To me, that was the most important piece, that this is not going to herald something worse.”

What drove the sell-off

This year has been a rather bumpy ride for investors. Markets have been impacted by escalating trade wars between the United States and China and rising oil prices. Recently, there have been concerns over the upcoming earnings season.

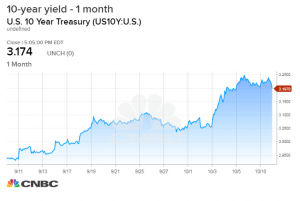

But the primary driver for yesterday’s slump were concerns over the rising FED rates. The 10-year U.S. Treasury yield is close to the 10-year high of 3.2%. Investors are right to skeptical about a rise in interest rates as higher rates tend to restrain economic growth.

FAANG stocks routed

The FAANG stocks, Wall Street winners for several years, lost close to a combined $180B in market value. FAANG is an acronym for internet giants Facebook [FB], Apple [AAPL], Amazon [AMZN], Netflix [NLFX] and Google [GOOG].

Joe Saluzzi from Themis Trading stated, “A lot of the high flyers are the ones that have gotten beat up. The FAANG stocks, the Amazons of the world, they are up ridiculous. Those are momentum-type trades. A little air coming out is a healthy thing as long as fundamentals haven’t changed. I don’t have a problem with that type of sell-off.”

Sell-off picks up speed, impacts global markets

The sell-off was not limited to the United States market alone. According to this Wall Street Journal report, the Stoxx Europe 600 fell 1.8% in early trade while the mayhem in China continued with stocks falling 6%.

Indices in Japan, South Korea, and India were also down in early market trading. Analyst Paras Anand from Fidelity International stated, “The sharp selloff in the U.S. has likely caught no one by surprise. If anything, market participants have been wondering how, in the face of tighter money, a tighter labor market and rising oil prices, the U.S. has continued to be so resilient.”

Earnings season important

The upcoming earnings season is critical for the health of the stock market. Investors are wary about inflation impacting corporate earnings, driven by higher input costs. In case companies can outperform market estimates, we might be in for another short-term bull run that will take indices to record highs by the end of 2018.

You must be logged in to post a comment Login