Penny stocks are equity investments that are traded outside major stock exchanges. These stocks are traded at low prices and have a small market cap. As penny stocks are illiquid and highly speculative, they carry a high risk of investment.

The US Securities and Exchange Commission (SEC) defines penny stocks as shares with a value of less than $5. Typically, a penny stock is traded over the counter or by using pink sheets.

Despite the high risks of investment, penny stocks can be a lucrative form of investment because of its low price and higher prospects of return.

Here we look at 5 penny stocks that are very promising.

1. Neptune Technologies & Bioresources Inc [NEPT]

Neptune Technologies and Bioresources Inc is a Canada based wellness solutions provider. It offers nutraceutical products or standardized nutrients of a pharmaceutical grade.

MaxSimil is a patented ingredient and one of the premium products offered by Neptune. Other products include marine oils, seed oils, as well as oil extracted from legal cannabis.

Neptune also offers pet nutritional products.

In 2016, Neptune acquired Biodroga, a privately owned business solution provider for functional ingredients. Since April 2017, Neptune has become a licensed producer of Cannabis and Hemp Oil in Canada.

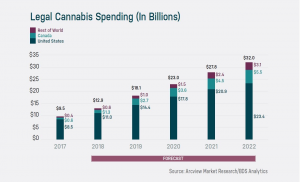

The monstrous growth in cannabis will hold NEPT in good stead. Analysts expect sales to rise 37% year-over-year to $39M in 2019.

Market Cap: $316M

Year-to-Date Return: 70%

Earnings Growth: 66.7%

2. Glu Mobile Inc. [GLUU]

Gaming has become one of the popular modes of entertainment. Glu Mobile is a game development company targeting mobile phones and smart gadgets.

The brand has already come up with multiple action games as well as mobile versions of console and arcade games. One of the popular role-playing games “Kim Kardashian: Hollywood” released by this company features the life of a reality TV celebrity. Glu Mobile Inc. primarily targets the female audience and over 60% of its games are female-centric.

What’s more, most of the games developed and launched by this company are free and can be downloaded from the Google Play Store [GOOG] or the iOS App Store [AAPL].

The primary source of revenue is from the in-app purchases.

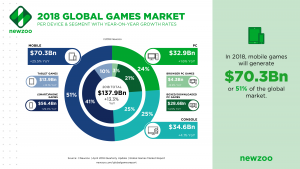

Glu Mobile has benefited immensely from the exponential growth of mobile gaming. With the global gaming industry set to experience robust sales over the next few years, Glu Mobile might be on the radar of several investors and analysts.

Analysts expect the company’s revenue to rise by 18% this year and 12.3% in 2019.

Market Cap: $1B

Year-to-Date Return: 103%

Earnings Growth: 40%

3. Arotech Corporation [ARTX]

Arotech Corporation is a successful mixture of modern technological innovations for federal use. There are two primary divisions of Arotech. One is the Training & Simulation department while the second focuses on Power Systems.

The Training and Simulation Department clubs drone technology and virtual reality for military use and law enforcement. Many of the simulations are used for combat training. Additionally, it also offers security services and weapons simulations for aircraft and missile guidance systems.

FAAC is one of the subsidiaries of Arotech Corporation. It was awarded a contract by the US Marine Corps. FAAC will be responsible for updating the convoy systems and the contract is valued at around USD 29 million.

Headquartered in Ann Arbor, Michigan, this defense and security company has been in existence for more than two and a half decades. Analysts expect revenue to rise by 1.3% to $100M this year and 11.8% to $111.8M in 2019.

Market Cap: $90M

Year-to-Date Return: -3%

Earnings Growth: 127%

4. CAS Medical Systems [CASM]

Medical and Healthcare sectors are seamlessly adopting modern technologies. CAS produces as well as markets products that can be used to monitor a patient’s vitals. Its products can be used to track patients without the use of invasive methods.

MAXNIBP is its traditional product to measure blood pressure. The company also offers a product called FORE-SIGHT which is a Tissue Oximeter with sensors.

Analysts expect CAS’ revenue to rise by 6.8% to $20M this year.

Market Cap: $63.3M

Year-to-Date Return: 196%

Earnings Growth: 15%

5. Dolphin Entertainment [DLPN]

Here’s another content production company — Dolphin Entertainment, Inc. engages in marketing and providing publicity services to major film studios, and many of the independent and digital content providers.

It is, however, flying under investors’ radar as the limelight is focused on content giants such as Netflix [NFLX], Disney [DIS] and others. It recently acquired 42West that expands its revenue stream into the public relations space.

Analysts expect Dolphin’s revenue to rise by 4.9% to $23.5 million this year, and 19.4% to $28 million in 2019.

Market Cap: $35.36M

Year-to-Date Return: -30%

Earnings Growth: 82.4%

6. Fura Gems [FURA]

Fura Gems is primarily a natural resource company. It engages in the acquisition and exploration of resource properties. The company was founded in 2006 and headquartered in Toronto, Canada.

This penny stock is currently trading at $0.40. The gemstone mining and marketing company is eyeing a share of 8-10% in the global colored stone market over the next three years. The market is estimated to reach$2B in 2021 which translates into annual revenue between $160M and $200M for Fura Gems.

Fura Gems is looking to expand its footprint in Mozambique and recently acquired nine ruby assets in the country.

Market Cap: $48.4M

Year-to-Date Return: -28%

You must be logged in to post a comment Login