In our second edition of the Battle Of The Stocks, we size up two technology giants: Apple [AAPL] and Samsung [SSNLF]. These behemoths are at constant war against each other, especially in the smartphone space.

Every new version of an iPhone launch is met head-on with a sleek, new Samsung model. The technology platform for Android [GOOG] vs iOS makes the battle even more interesting.

But what do the numbers highlight about these companies? Which stock is a better buy

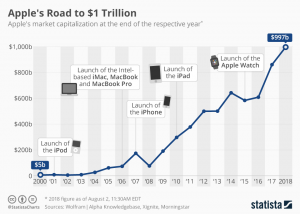

Market Capitalization

Samsung has a global market valuation of 314.65T South Korean Won (which translates to roughly $282B). The share opened at a price of SKW 46,550 (USD 41.72) yesterday. The stock has been on a consistent increase almost every half-year when it declares its financial statements.

In comparison, Apple has a market cap of $ 1.07 trillion. It was the first US-based company to reach a valuation of $1 trillion in August this year.

Revenue Growth

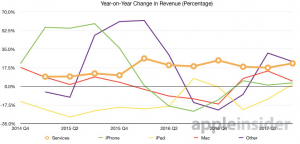

These two companies continue to drive revenue growth with a slew of innovative products and services.

Samsung is currently poised to record sales of $251.09B in the current year, a rise of 4.7%. Sales for 2019 is estimated at $260B.

The forecasts for Apple look much brighter than that of Samsung. The average estimated sales for 2018 is $263.82B, indicating a revenue growth rate of 15.10%. The expected turnover for 2019 is $280B indicating a sales growth of 6.20%.

WINNER: Apple

Profitability Index

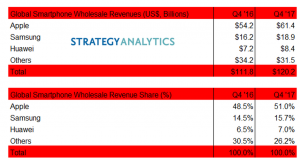

Apple accounted for a mind-boggling 87% of smartphone profits last year and almost 51% of total smartphone revenue. Apple recorded an operating margin of 26.8% in fiscal 2017 with net margin just short of 21%.

In comparison, Samsung has posted an operating margin of over 23% in 2017 and a net margin of 17.3%.

WINNER: Apple

Earnings Growth

We have seen that the two companies are expected to improve profit margins this year. This will translate to earnings growth as well.

Analysts expect Apple’s earnings to rise 27.8% this year and about 10.8% over the next five years. Comparatively, analysts expect Samsung’s earnings to rise 18.5% this year and almost 8.2% over the next five years.

WINNER: Apple

Smartphone market share

Samsung is a clear leader in the smartphone market with a share of 20.9% at the end of Q3 2018. Samsung’s smartphone shipments in the last quarter totaled 71.5M units.

Apple has a share of 12.1% with shipments reaching 41.3M units in Q3. Although Apple has a relatively lower market share, its products still capture many consumers in major emerging markets.

Apple is losing market share to China’s Huawei, Oppo, and Xiaomi. However, the company’s high average selling price ensures the majority of smartphone revenue is pocketed by Apple.

WINNER: Samsung

Apple leads the way in earnings growth, revenue growth, and profitability. Its Services business segment is already as big as a Fortune 100 company and a key revenue driver for the firm. It is also a high-margin business and will drive profitability as well.

With the launch of path-breaking products expected in the future (the Apple Car is expected to launch by 2023), the Apple stock seems like a safe long-term bet.

Samsung has been struggling to match the quality of Apple products. Its smartphone fiascos are well known. What’s more, the semiconductor industry is battling a downturn and Samsung is set to face short-term headwinds.

While Apple’s stock has surged 33% this year, gaining $230B, Samsung has declined 7% and lost over $20B in market cap.

Wealthlab Verdict: Apple (3-1)

You must be logged in to post a comment Login