Investing in stocks is tricky. But what if you get a stock that has been pummelled over the course of this year and still remains a market favorite? You would want to get in.

Leading gaming company Activision Blizzard [ATVI] is one such company. Shares are down 26% in 2018. Stocks of major gaming companies have also depreciated considerably this year. Electronic Arts (EA) has slipped 20% this year while Take-Two Interactive (TTWO) is down over 3%.

The largest gaming company in the world (Tencent [TCEHY]) has lost almost a quarter of its market value (amounting to a whopping $125B) year to date.

These gaming companies have had a stellar run over the last few years. This market correction has been long overdue and shares are now trading at conservative multiples.

Activision Blizzard shares are trading at $46.52 a share which is 45% below its 52-week high of $84.68. Since the start of October, shares have declined over 44%. With a relative strength index of 27, Activision Blizzard shares are trading well into oversold territory.

The share is trading just above its 52-week low. Activision shares were at these levels way back in February 2017. The stock has grossly underperformed broader markets and burnt significant investor wealth. However, this pullback in shares provides investors with an opportunity to enter the stock.

So why do you need to invest in the stock? The fundamentals are strong. Activision Blizzard has significant upside potential with robust earnings growth driven by expanding profit margins. Let’s have a look at each of these metrics.

Activision Blizzard has bottomed out

Activision Blizzard shares were impacted by the mind-boggling success of Fortnite. Activision’s latest “Call of Duty: Black Ops 4” title generated $500 million in the first weekend of its launch. While this is mighty impressive, the “Call of Duty: Black Ops 2” saw sales of $500 million in the first 24 hours since its launch.

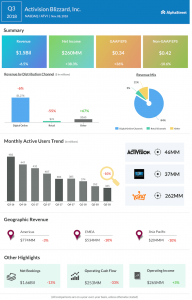

Investors and analysts were expecting a similar response and were left disappointed. It also reported a fall in monthly active users (or MAUs) from 384 million in Q3 2017 to 352 million in Q3 2018. All of these factors sent the stock spiraling downwards.

It certainly seems that Activision Blizzard shares have bottomed out and are set to take off on their next bull run. All the recent events have been priced in that has led to this massive decline. So what will drive the stock upwards?

Activision Blizzard is one of the premier gaming companies with a market cap of $35.5 billion. Yes, there are other companies such as Electronic Arts (EA) and Take-Two Interactive [TTWO] that are direct competitors, but with a solid portfolio of franchises, Activision Blizzard can easily hold its own.

Despite the recent pullback, Activision Blizzard has created significant value over the years. It has risen 173% in the last five years and 400% in the last ten.

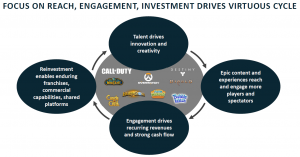

Strong gaming portfolio

The company has time and again released blockbuster franchises over the years. Though “Call of Duty” is Activision’s flagship franchise, it has other vastly popular games such as “World of Warcraft,” “Star Craft,” “Destiny Overwatch,” and “Hearthstone.” Yes, the recent “Call of Duty” game was not as well received as expected, but $500 million sales in three days is still mind-blowing.

Activision also acquired King Digital way back in 2015 for $5.9 billion to enter the digital and mobile gaming space. King Digital’s portfolio includes “Candy Crush,” “Bubble Witch” and “Farm Heroes.” The move into digital has resulted in a stable stream of recurring revenue for the firm.

Despite the fall in monthly active users, Activision Blizzard stated that the average user still spent 52 minutes gaming daily — an all-time high. It also has seven of the top 20 most viewed games on the industry’s largest streaming platform.

In-game purchases crossed $1 billion in sales for the third consecutive quarter.

The strategic shift toward eSports

Activision Blizzard has also been one of the first movers into the high growth eSports vertical. “Overwatch” found major success, and Activision Blizzard signed multi-million dollar deals with broadcasting partners such as Amazon’s [AMZN] Twitch.

It has now added six new teams bringing the total number of teams to 18. The eSports industry is still at a nascent stage and will be growing at double digits over the next few years.

The eSports industry has opened up opportunities in verticals such as advertising and licensing as well.

High growth industry

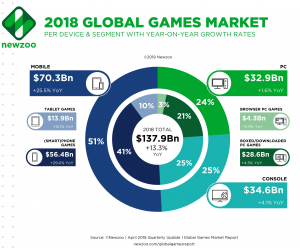

The global games industry is a high growth one and is estimated to rise from $138 billion in 2018 to $180 billion by the end of 2021. The mobile gaming market will lead growth and rise from $70 billion to $106 billion in the forecast period.

It’s very likely that King Digital’s mobile portfolio will lead this growth, gain traction and expand revenue over time.

So what’s next?

Activision’s revenue has risen from $6.6 billion in 2016 to $7.15 billion in 2017. Analysts expect sales to rise by 4.4% to $7.47 billion in 2018, 3% to $7.7 billion in 2019 and 8.9% to $8.37 billion in 2020.

The shift towards digital gaming has massively driven profit margins for Activision Blizzard upwards. The operating margin for gaming firms is similar to those of traditional software companies.

Here’s what the experts say

With the recent price drop, institutional investors hold 93% in ATVI stock. Out of the 27 analysts tracking Activision Blizzard, 20 recommend a “buy” while seven recommend a “hold.” There is not a single “sell” recommendation.

The analysts have a low target price of $56 while the high target price is $93. The 12-month average target price stands at $73.69, indicating an upside potential of 58.4% from current levels.

Institutional investors are betting on Activision Blizzard. And you should too.

You must be logged in to post a comment Login