Wealth Hacks

[PREMIUM] Why Copywriting Is The #1 Business Skill In This Digital World…

Published

6 years agoon

Let me prove it to you…

Let’s say if you want to sell any product or service on the internet and there are no written words on the landing page that can tell about your product or services…

Now, Do you expect someone to buy your product or services?

The answer is no: why?

Because there is no communication between you and the customer…

and It’s similar to a Salesman who has a product but he is not communicating with his prospect…

Guess What? You can’t sell anything this way…

As a Salesman you need to Communicate with your prospect and you need to tell everything about your product, and how your product can help them and can make their life easier…Right?

And the same rule applies on the Internet…

On the Internet, the only possible way to do a Communication is Copywriting…

Whether it’s a Video Copywriting Script, written or anything else…Everything needs copy!

So You need to Master the Art of Communication if you want to sell anything Online…

The Importance of Copywriting

Think about a Salesman, a salesman can have an average product but if he knows how to sell something and how to Communicate with others…he can sell anything

But if he doesn’t know how to communicate and how to sell, then It doesn’t matter how good his product is…he can’t sell.

Right?

So this is Exactly why you need a good copy to sell your products or services.

So Basically Copywriting is Nothing but the Art of Communication Through your Written words…

Here are a few bullet points that define Copywriting

- The Written words that draw people In…

- It opens up their imagination…

- It brings out emotion…

- It makes it possible for the consumer to relate to the salesperson…

And that’s what is all about – Relating

And every marketer must need to know at least the basics of Copywriting…even if you are outsourcing.

Where we use the Copywriting?

The Answer is everywhere you need to communicate with your customers…

For Example

- The written Sales Letter

- The Video Sales Letter

- The Webinar

- Ads Copy

You see, Copy is everywhere, the website, the product description, Book Titles, etc

And You Must need to know that Copywriting is NOT the same thing as writing content.

They Both are Different

Copywriting Vs Content Writing

When writing Content, the goal is to teach, educate and give People Information.

This is Not the goal when writing copy

When writing copy, the goal is to build the relationship, trust, to pump them up, get them excited and convince them they need to click.

Copywriting Vs Content Writing

Our Responsibility to keep their attention Vs their Responsibility to keep their attention

Convincing/Influencing Vs Teaching

Now Let’s look at this 5 – Step Copywriting System

The 5 Step Copywriting Formula

This is the proven Formula that Every Good Copywriter uses to write a good copy

And anyone who follows this will be able to write great copy every time.

1 – Introduction

2 – The Story

3 – The Content

4 – The Transition

5 – The Pitch

Now Let’s Master These Step by Step

Ready?

Perfect! Here we go…

Step 1. Introduction

The Introduction is the #1 Important part of your copy…

Yes, you’ve heard it correctly…It’s the #1 Important part of your copy.

Why?

Because the Introduction is the First Line that your Reader sees, and you need to write something that draws their attention and attracts them to read your full copy. If it fails to do this, everything else is useless…because the reader can Instantly click on the back button and go out.

So Let’s Clear the Purpose of Copywriting again – The Purpose of Introduction is to tell them why they should read your copy…

The goal is to capture their attention and here are a few points to do that…

- Tell them ‘What’ NOT the ‘How’

- While writing the Headline keep this in mind to tell the what, what’s in it for them, what the product or offer can do for them.

- Give them a Convincing enough “what” and they will want to know the “How” enough to Buy.

For Example – How to Ditch your Boring 9 to 5 Job and Earn 7 Figure Income using just your Laptop.

Now this headline gets the attention of those who want to quit their job…

So they will definitely go read to find out ‘How’

Right?

And once they are hooked by the headline, tell them a Story…

Step 2. The Story

Storytelling is one of the greatest marketing strategies ever to sell something and to build a connection and trust. Because everyone can understand the story and can relate to a story.

But You need to present a story in such a way so that your readers or prospect can connect with you…

Here’s something that you need to keep in mind…

- People don’t buy products. People buy the story… people buy what is behind that product – The Brand or the Person.

- The Purpose of the story is to Connect with People and to build trust.

- To Bring out their emotions, because people make buying decisions based on emotions.

So You need to present a story in such a way that people can relate to you. And you need to bring out their emotions.

Once the story is over, The Next Step is…

Step 3: The Content

At this point, your customers want to know more…

They want to know if your product is a good fit for them or not and whether you are the right person to sell the product or not!

So the Goal of the content is to prove that there is no other option than this product!

And To Accomplish This, the content must provide value and to make them feel that they need this product to change their life…

In the Content, we need to show the statistics, facts that can blow their mind.

For Example; Again the same headline

– How to Ditch your 9 to 5 Boring Job and Earn 7 Figure Income Just Using your Laptop…

So In content, you need to prove to them; Why Job is Bad for them, and Why Job Economy is dying and some more statistics…and the Solution

and if you can do that…and can convince them, they are sold…

Now let’s look at the next step…

Step 4. The Transition

At this point of time, you need to give them a simple and logical reason why you are asking for money…

Because In the last 3 steps, you have provided so much free value…and you have built a relationship with them.

So now you need to give them a simple reason…why Money!

You simply can’t say that Buy this product because I am selling…No!

You need to give them a logical reason, that this is your mission, you are building your legacy and this product is a part of it. Or whatever the reason that you have!

Then Move on to the Final Step

Step 5; The Pitch

The Purpose of the Pitch is not to sell, selling is already done in content, this is where you confirm the sale…

And How to Confirm the sale?

Showing them that the Provided Value is greater than the price.

You need to show them everything that you are giving in exchange of money…

Give them a completely irresistible offer and that’s it.

For Example – If your Product Cost $1, then show them that they are getting the value of $10 or more.

Finally, I congratulate you for Going through the 5 step Process of Copywriting!

Now, Start Implementing these steps to Boost your Conversion!

But Wait, aren’t you curious to know about me?

Hi, I am Durvesh Yadav,

also known as (@10xmentor) 20 year Kid, Social Media Influencer And Digital Entrepreneur, I help Digital Coaches To Scale their Online Business Using My Copywriting and Marketing Skills.

Thank for Reading this, I hope it will help you to make more money online.

🙂

You may like

-

Airbnb Experiences: 5 Easy Ways To Make Extra Cash Today

-

10 Tips for Making More Money with Your Airbnb Listing

-

From Pet Rocks to Potato Parcels: 5 Crazy Ideas That Made Millions Online

-

From Zero to Millionaire: How 9-5 Marketing Guy Made A Fortune Selling Pet Rocks As A Joke (1)

-

How Big Real Estate Moguls Avoid Taxes (And How You Can, Too) 👀

In times of economic uncertainty, gold has long been a reliable investment option for those looking to hedge against inflation and volatility.

If you’re looking to invest in the production of gold, as well as gold itself, here are three stocks you can buy inside the NYCE app today.

1. Barrick Gold Corporation (GOLD)

Barrick Gold Corporation is one of the largest gold mining companies in the world with operations in North America, South America, Africa, and Australia.

Performance: Barrick Gold Corporation has experienced steady growth in the past decade, with its stock price increasing by 31% from 2010 to 2020.

Known for: Barrick Gold Corporation is a leader in responsible mining practices, and is committed to environmental sustainability and social responsibility.

NYCE APP CTA:

2. Newmont Corporation (NEM)

Newmont Corporation is one of the world’s leading gold mining companies with operations in North America, South America, Australia, and Africa.

Performance: Newmont Corporation has experienced significant growth in the past decade, with its stock price increasing by 184% from 2010 to 2020.

Known for: Newmont Corporation has a strong track record of responsible mining, and has been recognized as a leader in environmental stewardship and social responsibility.

3. Franco-Nevada Corporation (FNV)

Franco-Nevada Corporation is a royalty and streaming company that provides financing to gold mining companies in exchange for a share of their future production.

Performance: Franco-Nevada Corporation has experienced substantial growth in the past decade, with its stock price increasing by 780% from 2010 to 2020.

Known for: Franco-Nevada Corporation offers investors exposure to the gold industry without the risks associated with mining operations, making it a popular choice among risk-averse investors.

Wealth Hacks

From Pet Rocks to Potato Parcels: 5 Crazy Ideas That Made Millions Online

Published

3 years agoon

April 26, 2023

From selling cookies on the streets of New York to sending personalized messages on potatoes, these five entrepreneurs turned their unconventional ideas into multi-million dollar businesse

- “How a High School Dropout Made $10 Million Playing Video Games Online”

This story is about Matthew Haag, also known as Nadeshot.

Nadeshot. 🤨

He dropped out of high school to pursue a career in gaming and became a professional gamer. He has since won multiple championships and has a large following on social media.

- “Meet the Teen Who Turned His Hobby into a $1 Million E-Commerce Business”

This story is about Cory Nieves, also known as Mr. Cory.

Mr. Cory started a cookie business at the age of six, selling cookies on the streets of New York.

He eventually turned his hobby into a successful e-commerce business, selling cookies online and in stores.

He has been featured on various media outlets and has even baked cookies for Oprah Winfrey.

- “The Surprising Story of the Stay-at-Home Mom Who Made $100K in One Year Blogging About Knitting”

This story is about Sarah Corey, who started a knitting blog called “My Simple Knitting” while staying at home to raise her children.

Her blog became popular and she eventually started selling knitting patterns and products.

She made over $100K in one year from her blog and has since turned her passion for knitting into a successful business.

- “How One Man’s Love for Potatoes Turned into a $5 Million Online Business”

This story is about Alex Craig, who started a website called Potato Parcel where he would send personalized messages on potatoes.

His business gained popularity and he has since expanded into other products, such as potato socks and potato candles.

He has been featured on various media outlets and his business has grown to make millions of dollars in revenue.

- “Pet Rock Creator Gary Dahl Turned a Silly Idea into a Million-Dollar Business”

This story is about Gary Dahl, who famously created and marketed Pet Rocks in the 1970s.

Despite being a seemingly ridiculous idea, the Pet Rock became a massive success, with Dahl selling millions of Pet Rocks and becoming a millionaire in the process.

READ: How This 9-5’er Made Millions Selling Free Rocks In His Spare Time

wealthlab is a platform for hustlers, doers, entrepreneurs and investors to do epic s&%. Our mission is to create 100M new investors worldwide. Join our academy here.*

Don’t miss:

- ‘I work just 2 hours a day’: A 24-year-old who makes $8,000 a month in passive income shares her best business advice

- This 38-year-old makes $160,000 per month in passive income—after losing his job: ‘I work only 5 hours a week now’

- This 33-year-old mom makes $760,000 a year in passive income—and lives on a sailboat: ‘I work just 10 hours a week’

Sign up now: Learn how to retire with $1M with our wealth academy.

Business

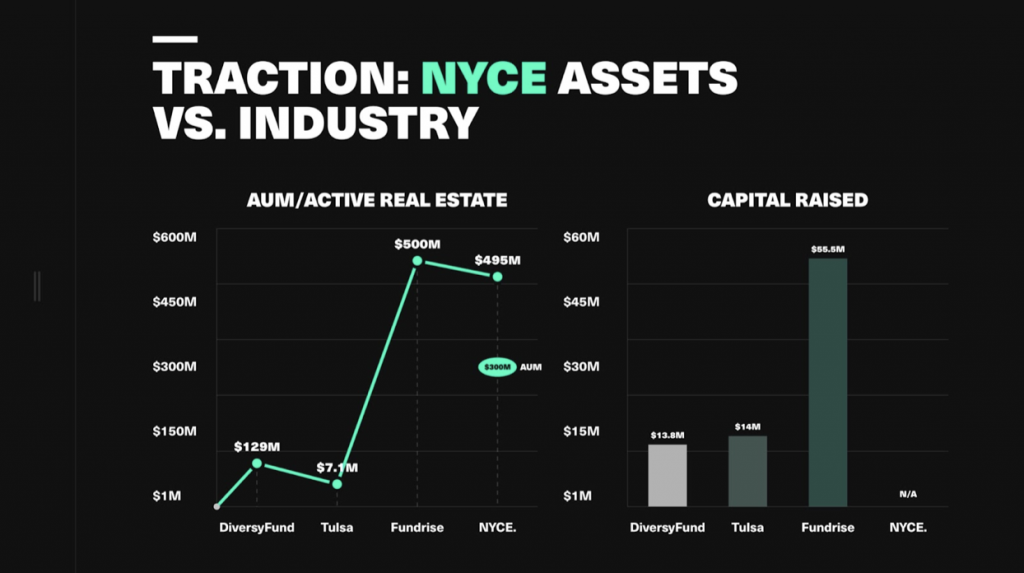

How I run a $300M+ business from the beach…(and how you can TOO!)

Published

3 years agoon

August 25, 2022

Yes, you read that right.

If there’s anything the pandemic taught us, it’s that the paradigm of “office” and “workspace” has been shaken to its CORE.

Universities are teaching via Zoom, court dates are done virtually, FULLY REMOTE businesses are valued at $1B+, and legitimate Inc. 5000 startups are run from…wherever. 📲

This is my office for the day…

I am actually running our business from the beach, typing this from here.

It’s 4:28 pm CET, which means it’s 10:28 am EST and I am CRUSHING my to-do list.

(And the team will continue to crush it while I’m asleep. That’s the 🗝)

So how did we get here?

We launched NYCE and our mission to create 100,000 millionaires in March, 2020…just as the global COVID-19 lockdown happened. 😳

As a result, we shut down our main office and set EVERYTHING up to run remotely…

SMOOTHLY! And a system that allows us to outperform competition by 200%. (You can build this system, too. More on this in a second.)

Here’s what we were able to do since then:

- Gained 6M+ followers across all platforms 📈

- Add 1500+ new apartments to the portfolio 🤑

- Grow to $300M in real estate 🚀

- 105% investor returns 🎉

- 700K+ community members 🤝

And here’s the best part…

Having team members in all the main time zones gives us a 24-hour work cycle vs. 9-5/eight-hour on-the-clock performance.

This means we get 3x the productivity of a similar company. 🔥

Let me repeat that…3x PRODUCTIVITY vs. our competitors.

Meanwhile our project management software grants us 24-hour TEAM-WIDE connectivity that tracks all tasks and lets us know if productivity dips even a little bit.

There is ALWAYS someone senior awake. It could be Martin in Barcelona…Nat in New York…Vineet & Arif in New Delhi.

All the while giving YOU GUYS wealth hacks and daily content. 🔥

OK, so how can you do it?!

Well, the first step is to have an actual side hustle you’re launching. Not just an idea, a validated business.

MAJOR KEY: Do NOT spend money until you’ve made your FIRST DOLLAR! 🗝🗝🗝🗝

(You can catch a replay Business Launch masterclass here and see TRIBE member Nessa launched her business on the spot and got her first $45K client shortly after.)

One of the easiest ways to start is with Airbnb—you can start that in 10 minutes. Literally. (Here’s a guide if you need it.)

Once you have your business, you build a virtual infrastructure (you really just need two softwares, which are FREE), manage the team accordingly and run the business from there.

I’m gonna put together a step-by-step video breakdown this weekend inside the new TRIBE U on the FIVE key things you need to do this for YOURSELF. 💵 💎

From what software to use, how to build a team, how to keep.

In the meantime, drop a comment if you’re ready to build some wealth and any questions if you want more…

Let’s get to work. 🙌

PS: If you can’t be bothered with video and just wanna get to work, we’re hosting a TRIBE U workshop that will help you get this process started on the spot. It’s $479 $49. 🔥

Top 5 Best Investment Strategies To Survive A Recession

The Top 10 Investment Opportunities To Capitalize On During A Recession

3 Gold Mining Stocks To Buy Today 📲

Ad 1

Trending

You’ve reached your free article limit.

Continue reading by subscribing.

Already a subsciber? Login >

Go back to Homepage >