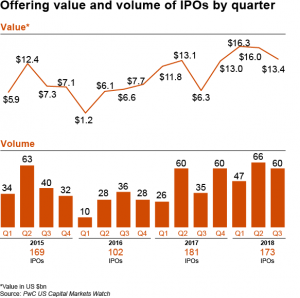

The IPO (initial public offer) space is getting back on its feet this year, after having clocked listings of 173 companies on public exchanges in just under 9 months. The number trumps those recorded last year, 160 companies, and in 2016, 105 IPOs.

In the second-quarter of 2018, over 60 companies went public which was the highest number in over 3 years. Companies raked in excess of $45.7B in the first 9 months of 2018, significantly up from $31.1B in the same period last year.

Here, we look at 5 of the highly anticipated IPO’s in 2019.

Uber

Uber is pitched as one of the most popular car aggregator globally. While its current valuation is around $72B, the company might be valued at $120B when it goes public in 2019.

This will mean Uber is valued higher than Ford [F], General Motors [GM] and Fiat Chrysler combined. It also indicates a premium of 67% from Uber’s current valuation.

Goldman Sachs [GS] and Morgan Stanley [MS] are leading investment banks that might take the company public. It will be interesting to see if investors line up for a company that has posted losses in every quarter since inception.

Total Funding: $23.85B

Valuation: 72B

Airbnb

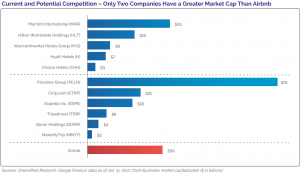

The Uber for vacation rentals and long-term accommodations, Airbnb is another unicorn that is eyeing an IPO next year. Airbnb has raised approximately $4.4B to date and is one of the most valued start-ups in the world.

Airbnb has been profitable on an EBITDA (earnings before interest, tax, depreciation and amortization) basis for a while now and is not burning money compared to other tech start-ups.

The company is eyeing an IPO and has set a goal of June 30, 2019, to be “IPO Ready”. Airbnb might generate sales between $3.5B and $4B in 2018.

Total Funding: $4.4B

Valuation: 31B

Deliveroo

Deliveroo is a UK-based company and is one of the country’s hottest and most valuable startups. Started by a former investment banker, the company is an end-to-end food delivery service that connects local restaurants with customers.

There have been talks about Uber acquiring Deliveroo to integrate the same with the Uber Eats vertical. Deliveroo is another company that might go public in 2019.

Total Funding: $1B

Valuation: 2B

DJI

DJI is the largest drone manufacturer globally. It is dedicated to make aerial photography, filmmaking more accessible. DJI’s products are available in over 100 countries.

Earlier this year, DJI was planning to raise between $500M and $800M ahead of its stock market debut.

Total Funding: $105M

Valuation: $8B

Lyft

Lyft is Uber’s direct competitor and is locked in an IPO race. Earlier this year, Lyft raised $600M at a $15.1B valuation. JP Morgan [JPM] is in talks with Lyft to take the latter public as an underwriter.

Total Funding: $4.9B

Valuation: $15.1B

You must be logged in to post a comment Login