In this edition of Battle Of The Stocks, we look at two stocks in the online food delivery and reservation business, Yelp [YELP] and GrubHub [GRUB]. While Yelp has well over a million restaurants on its website, GrubHub is an established online ordering service.

The two companies are an online ordering platform that connects diners with restaurants. Here, we look at which stock is a better buy at current levels.

Market Cap

Driven by the massive increase in share prices, the market cap of Yelp and GrubHub have grown significantly since the start of 2016.

Shares of Yelp are trading flat this year driven by a 15% decline in Oct. 2018. The stock is however up 70% in the last 3 years and 50% in the last 18 months.

Comparatively, the GrubHub stock has gained over 250% since 2015 and 100% in the last 18 months. Despite a 36% decline in Oct., the stock is up 24% this year, easily beating returns of major indices.

This staggering climb in value resulted in billion-dollar valuations for the two companies. Yelp’s market cap is currently $3.5B while GrubHub’s market cap is higher at $8.1B.

However past returns are not an indicator of future price movements.

Revenue Growth

Revenue growth is a key indicator to gauge the financial position of any company. Any firm that can grow its revenue at a robust rate will be worth investing in.

Yelp reported sales of $844M last year and it’s estimated to rise 14% to $963M this year. Analysts expect its revenue to grow 18% to a robust $1.14B in 2019.

GrubHub, on the other hand, reported sales of $680M last year and analysts expect its revenue to grow 34% to $1.4B.

WINNER: GrubHub

Profitability

The profit margins of these online ordering portals have expanded, driven by a rise in revenue and operating efficiencies. While Yelp’s operating margin is estimated at 2.8% this year, it’s expected to be 5.4% next year.

GrubHub, however, sees the operating margin at an estimated 18.7% for the current fiscal, while it’s expected to be 18.5% next year

WINNER: GrubHub

Earnings Growth

While the two companies are looking to improve profit margins, analysts and investors are concerned over the earnings growth potential.

Analysts expect Yelp’s earnings per share (EPS) to grow 21% over the next 5 years. Comparatively, analysts expect GrubHub’s earnings to rise 27% over the same period.

WINNER: GrubHub

Analyst Recommendation

We have looked at key financial metrics for the two stocks. Let’s see what Wall Street analysts expect from the companies. Analysts have a 12-month average target price of $51.22 for Yelp, indicating an upside potential of 23%.

Comparatively, analysts expect GrubHub’s share price to rise to $296.94, providing an upside potential of 41% over the next year.

WINNER: GrubHub

It looks like GrubHub is a clear winner in this race. GrubHub is a better bet considering its profit margins and revenue and earnings growth rate. GrubHub also holds an edge due to a larger footprint and a solid reputation for customer service.

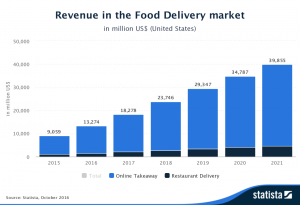

The food delivery segment is a high growth one with both companies looking to upstage the other and gain market share. We can see above that the domestic food delivery market is estimated to grow from $23.74B in 2016 to almost $40B in 2021.

Wealthlab Verdict: GrubHub (4-0)

You must be logged in to post a comment Login