From October 1 to November 23 last year, the NASDAQ fell nearly 14% and the S&P 500 fell 10%.

Ouch!

Then over the last week in November, the S&P 500 rebounded 5%.

Whew!

Then it tumbled again, and wiped out its gain for the whole year.

Feel whipsawed? Sure. We all do. It’s in our brains. The financial markets are only a few centuries old, but our brains are much older — and they were “built” by evolution, not by Apple or IBM. When fear strikes, as it does during a downturn in the market, our evolved instincts tell us to run, same as we would from a fire, a flood or a predator. Applied to the stock market, our primordial urge is to sell, and preserve what we have.

But that urge is hopelessly wrong. It’s a false alarm, and a disastrous “choice” that can dwarf your portfolio forever. Both naïve and ostensibly savvy investors alike may obey that primitive instinct, cash out their portfolios with sighs of relief, and live to rue their decision. The day will come when the market comes roaring back, making new highs, as they cling to the proceeds of unwise sales, wondering when to buy back in — usually too late. There’s a very expensive lesson in this: the people on the other side of those trades were wiser.

In Why Smart People Make Big Money Mistakes, Gary Belsky and Thomas Gilovich relate the cautionary tale of a broker’s experience in the 1987 stock market turbulence. Over a hundred young clients called to sell all or part of their portfolio, hoping to stanch the bleeding. But two old hands over 80 called to buy. Experience beats intelligence.

How can we still our throbbing hearts as markets reverse or even tank, so we don’t sell in haste and regret it during the next market boom? Use the cultural wisdom already downloaded into your consciousness to mentally prepare for stock market reversals:

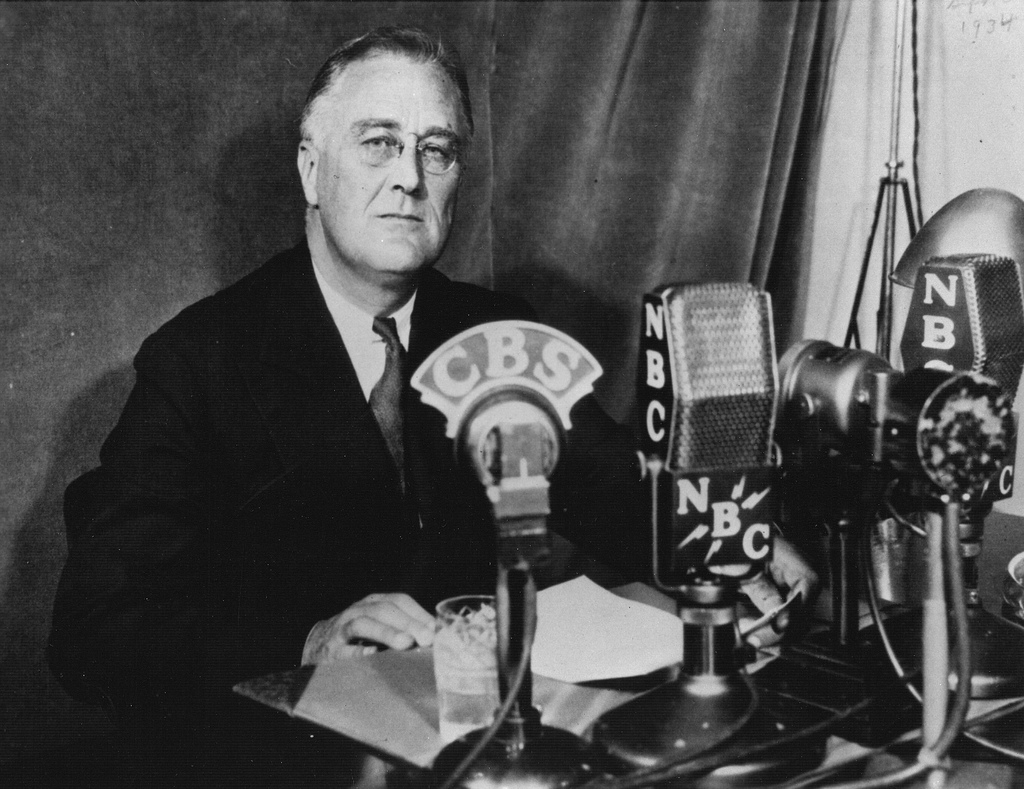

1. Listen to FDR.

“The Only Thing We Have to Fear is Fear Itself,” Franklin Delano Roosevelt said in his 1933 inaugural address. FDR was speaking to the nation about The Great Depression, then at its depth after the 1929 stock market turbulence. Master politician, master crowd psychologist, and member of the wealthy elite, FDR knew his history. He knew that prosperity would return in time, as part of the natural ebb and flow of markets and economies — if the sociopolitical consequences of the Great Depression could be held in check. In 1933, as in any market reversal, fear was his worst enemy.

2. Heed an ancient adage — and Lincoln.

“This too shall pass” is a renowned Persian, Hebrew and Turkish adage often misattributed to the King Solomon in the Bible. According to Sufi poets, the phrase was a passage etched upon a king’s ring. It was there to make him happy if he were sad and, sadly, to caution him that joy, too, is fleeting. But the most compelling recital of the phrase comes from President Abraham Lincoln: “It is said an Eastern monarch once charged his wise men to invent him a sentence, to be ever in view, and which should be true and appropriate in all times and situations. They presented him the words: ‘And this, too, shall pass away.’ How much it expresses! How chastening in the hour of pride! How consoling in the depths of affliction!”

3. Think like a mathematician.

“Invert, always invert,” said the mathematician Carl Jacobi. Mathematical inversion is a favored thinking tool for both Charlie Munger and Warren Buffett. It flips life’s problems up, down, around and backward until the answer presents itself unbidden. Buffett says, “It’s like singing country western songs backward. That way you can get your house back, your auto back, your wife back, and so forth.”

How can inversion be applied to market downturns and crashes? Invert the naïve impulse to sell into an informed decision to buy. Recognize that if you are wise enough to hold onto stocks for the long term, the price anyone would pay for them in a downturn is irrelevant. If you have wisely stored a cash hoard in anticipation of a downturn, you are not obliged to sell stocks in a down market to harvest cash. And because you are free to buy, the stocks are on sale! Buffett teaches: “Be fearful when others are greedy, and greedy when others are fearful.” But take caution not to buy too soon. Wait until the market bottoms, or in Wall Street parlance, “Don’t try to catch a falling knife.”

4. Shakespeare was right.

“Cowards die many times before their deaths, The valiant … but once,” wrote William Shakespeare. If you fear the market and keep most or all your money in cash or cash equivalents, inflation will, in the fullness of time, destroy your cash hoard. It’s financial death by a thousand inflationary cuts. Though the nominal two percent inflation rate is hardly noticeable day to day or even year to year, compounded over six decades, a dollar is only worth a dime.

If you are wise enough to invest, not play the market or buy and sell, but be brave and hold a steady course through storms and routs, diversified and shielded from taxes in a retirement account, you will find yourself a hero at retirement. And, moreover, to your survivors when you are gone.

This article originally appeared on ValueWalk. Follow ValueWalk on Twitter, Instagram and Facebook.

You must be logged in to post a comment Login