The numbers say 80% of millennials don’t invest in stocks.

Reason? Half say they don’t have money, one-third says it’s too early and another third says they don’t know how.

In addition to that, there’s demographic gap. “The average age of a financial advisor is 55,” said Douglas Boneparth, a New York City-based financial planner. “There are more financial advisors over the age of 70 than there are under 30.”

Despite these beliefs, you don’t really need much money, nor experience, to get started. (Just look at our fearless co-founder Odunayo Eweniyi and what she’s pulled off here)

Be that as it may, here are three ways to get started for $5 or less.

1. Stash

What: A micro-investment app (iOS and Android) with over 30 ETFs according to industry, sector and risk tolerance.

How it works: Download the app and choose your investment.

Minimum investment: $5

Cost: Fees range from $1 a month for accounts under $5,000 to 0.25% a year.

“We help people who don’t have a lot save money on a weekly basis,” CEO and co-founder Brandon Krieg said in one interview. “Stashers look like America, they look like people you meet every day: they are nurses and teachers and Uber and Lyft drivers.”

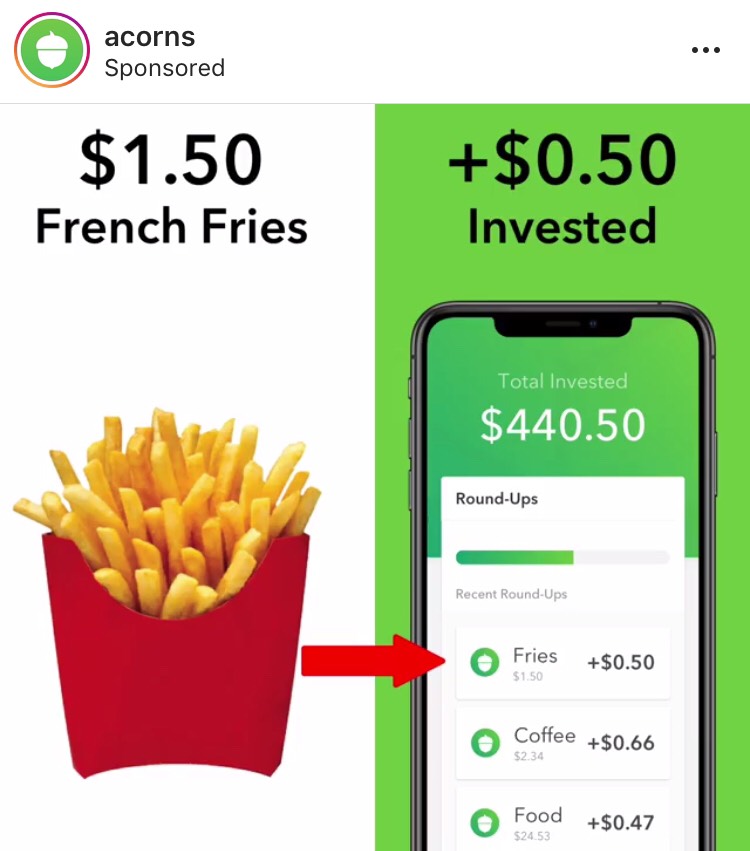

2. Acorns

What: iOS and Android app.

How it works: Download the app and choose one of six index funds. When you buy, say a cup of coffee for $1.75, it rounds up the change to $2 and deposits the difference.

Minimum investment: $5

Cost: Just like Stash, fees range from $1 a month for accounts under $5,000 to 0.25% a year.

“We’re not trying to preach austerity to the client, because that’s a bummer,” CMO Manning Field says. “Some people will say, ‘Don’t have the cup of coffee.’ We’ll tell you to have the cup of coffee and invest along the way.”

3. Robinhood

What: A commission-free investment app (iOS and Android).

How it works: Download and start buying stocks.

Minimum investment: Whatever stock you want to buy.

Cost: Free.

And by the way, if you want to get a fast start on real estate, here’s Forbes’ list of nine REITs with yields between 8% and 10%.

You must be logged in to post a comment Login