There’s a lot of “rules of thumb” floating around out there related to real estate. The one I hate the most is the 1% rule.

It’s wrong. It doesn’t work. Period.

Let me explain…

The 1% Rule Explained

Let me take a step back and explain the 1% rule first.

In a nutshell, it says that the monthly rent for your rental property should be at least 1% of the property value. If you can meet this goal then you can make some good money in real estate.

So, if you find a property that rents for $1,000/month and you can negotiate a price of $100,000 then you’re in good shape.

…at least according to the people pushing the 1% rule.

Breaking Down the 1% Rule

Let’s say that that you find a property that is $100,000 and rents for $1,000.

We know around 5-10% goes straight to vacancy. So, that leaves you $900.

And 50% of that goes to expenses. Leaving you with $450.

And a 30 year mortgage on an $80,000 loan (I assume 20% was put down) is around $429.

So, that leaves you around $20 – $70 (depending on vacancy) each month.

…not very sexy is it?

The Break Even Ratio

Traditionally, the 1% rule was considered the break even rule. Where you would most likely cover your debt when rents are 1% of your purchase price.

So, what happened?

I don’t know for a fact, but I think a couple of things happened.

Turnkey Real Estate Companies

First, I think that turnkey companies started pushing it as a solution. A turnkey company finds a distressed property, rehabs it, puts a tenant in there and sells it to you for at or above market price.

There is definitely some value to what turnkey companies do, but often they based their prices on the 1% rule and not necessarily on market value. That allows them to get higher prices in generally low cost markets.

They justify it with free education. They teach you that if you can get 1% of the value as rent, then the deal is great and you can make a ton of money…

To people on the west coast or other high-cost areas, this seems awesome because the ratios there are closer to 0.5%. So, relatively speaking, they are “great deals” even though they are overpaying.

Inexperienced Gurus

There are a ton of new gurus out there pushing all kinds of different ideas. Some are good and some are not, but the 1% rule keeps popping up, especially with online education.

Often, these are run by people who own a few properties and have done really well since the recession. It makes sense if you think about it. If you bought at 1% back then and rents and prices have almost doubled, then you are way above 1% based on what you purchased it for.

But, that is buying based on speculation that the market will improve, not based on the fundamentals of the deal.

Another common guru you see out there now is someone who’s only been investing for a few years. Even if they are doing great but they haven’t really been around long enough to see and understand the nuances.

They don’t realize that the 1% rule works when there are massive rent growth and appreciation but could never work in a sideways or downward trending market.

What About Using it As a Filter?

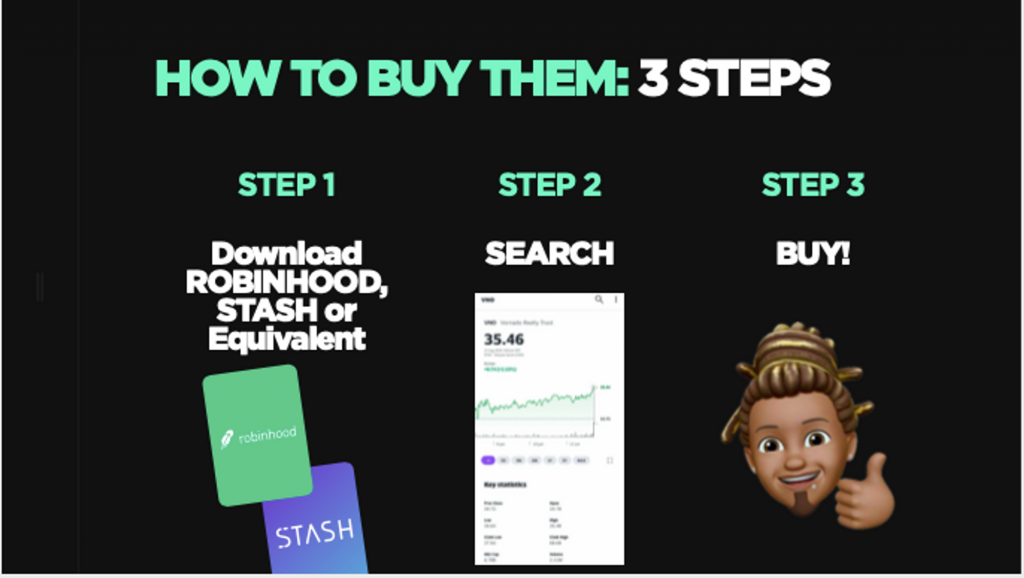

People will suggest using the 1% rule as a filter to go through hundreds of deals quickly. Here’s how they suggest you do it:

list all the prices, list all the rents, then calculate the ratios. Anything under 1% toss out and anything over 1% keep and look at deeper. So, a spreadsheet might look like this.

Based on this, you should consider buying the first, third, and fifth property on the list because the ratios are all above 1%.

But, this is missing a HUGE amount of detail. What is most important is not what it’s receiving for rent today, but what it could be receiving after you own it. So, you should based your numbers on potential rent not current rents.

Based on the new spreadsheet, the best potential deals are the 4th and 6th. While others may have potential as well based on the 1% rule, you see some really good ratios on deals you would have previously discarded.

That’s why the 1% rule is kind of silly. It leads you to discard potentially great deals in favor of more marginal deals.

Focus on The Numbers

The rent to price ratio is an important ratio to consider before purchasing anything. Just remember, it is a rule of thumb. Also, remember what it truly means:

The 1% rule is the break even rule not a rule to earn you money.

Rules of thumb are designed as a reality check. Things like the 50% rule to expenses or the 1% rule are there to act as a guide. If you are running the numbers and you’re rent is 1.5% while everyone else is at .75%, then you should think twice.

Or, perhaps your expenses are at 25% and everyone else is running at 50%. Then you should double check.

They are not and should never be used to make a buying decision.

That’s why I give away simple calculators like this one, to point you in the right direction.

This article originally appeared on IdealREI. Follow them on Facebook, Instagram and Twitter.