On Aug. 2, 2018, Apple [AAPL] created history as it became the first company in the United States to be valued at $1T as per market cap. Apple’s market cap rose to a high of $1.10T and has since slipped to its current valuation of $996.3B.

Despite the recent slide, Apple shares are up 25.5% in 2018. Now that it has crushed the $1T barrier, what’s next for the tech heavyweight? What will be the next revenue driver for Apple? Can the company be valued at $2T? Analysts definitely think so.

iPhone growth might slow down

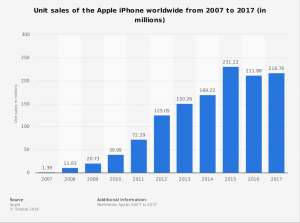

Apple’s stock was trading at $13 in Nov. 2008. The stock has since risen 1500% driven by the launch of Apple’s flagship product the iPhone as well as the hugely successful iPad. The global exponential growth in the smartphone industry created robust demand for what soon became Apple’s flagship product.

Now, this growth has stalled. The smartphone market is a mature one. Emerging markets like India will drive demand but the iPhone is too expensive for these markets. The iPhone has lost market share to Chinese companies such as Huawei, OPPO and Xiaomi.

Apple’s iPhone still accounts for over 59% of total revenue. In the recent earnings call, Apple CEO Tim Cook stated that the company will no longer publish device sales going forward. Is this an indicator of slowing demand?

Apple though remains an innovative company and allocates significant resources to research and development. It has time and again proved critics wrong especially over the last decade. Apple still remains a good long-term bet for investors. Let’s see why.

Apple’s Services business critical for the company

Apple’s Services business has been a major revenue driver for the company over the last several quarters. It accounted for 16% of total revenue in the last quarter and is as big as a Fortune 100 company in terms of revenue.

This business includes revenue from Internet services, AppleCare, Apple Pay, licensing and other services. The App Store, Apple Music and Apple Pay are all set to experience significant growth over the next few years.

Apple Music has already become the second largest music streaming platform in the United States, while the App Store generated 93% more revenue than the Google Play Store [GOOG] in the last quarter that has a far larger user base.

Apple has created a technological ecosystem with a high customer satisfaction and retention rate.

Apple Car rumored to launch by 2023

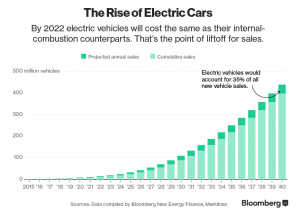

Noted Apple analyst Ming-Chi Kuo expects the company to launch the Apple Car by 2023 that will push it towards the next trillion dollar valuation. Kuo stated that Apple’s high growth services segment, AR futures, and its secretive car project (also known as Project Titan) will propel it towards a $2 trillion valuation.

This means Apple is looking to take advantage of the tectonic shift in the global automotive market. Several countries are already eyeing investments in the electric/hybrid car space as they are running out of options to combat global warming and climate change. The electric car is a terrific alternative and companies are now pumping money into this space.

Kuo stated, “Apple’s leading technology advantages (e.g. AR) would redefine cars and differentiate Apple Car from peers’ products. Apple can do a better integration of hardware, software, and service than current competitors in the consumer electronics sector and potential competitors in the auto sector.”

The $2T valuation seems like a distant dream for investors, especially in a difficult macro environment with trade wars, slowing demand, and rising interest rates. Apple though has always been able to catch the consumer’s attention with its high-end tech products and services. If the Apple Car experiences a successful launch, there will be no stopping this stock given the total available market.

You must be logged in to post a comment Login