Real Estate Investing

4 Ways To Make $10K A Month

Published

6 years agoon

The goal to make $10,000 a month in passive income is just a long-shot dream, right?

Probably. I don’t even know why you’re reading this article…

Wrong!

If you’re looking for 5 more generic steps to take to never reach your goals, then stop reading now.

If you’re looking for “buy my program and you’ll be earning 6-figures and can quit your job” then you also should look elsewhere.

Instead, keep reading if you’re looking for some real solid steps on how to grow and build your passive income to a level that can replace your day-job.

How Can I Make $10,000 per Month?

The first question to answer is “how exactly do I make $10,000 per month?” There are really only 4 ways to earn $10,000 a month:

-

Get your boss to give it to you (earn it at a job)

-

Earn it yourself (become self-employed)

-

Create it (own a business)

-

Grow it (from investments)

This is a summary of the 4 general ways to earn income – employee, self employed, as a business owner, or through investments. It’s also called the ESBI model. The list is also ordered from least desirable to most desirable.

When you decide “I want to earn $10,000/month” you need to decide what path you are going to take first then refine it into ‘how’.

So, let’s start with the worst ways to create $10,000 and work our way up to the best.

How to Earn $10,000 a Month as an Employee

If grinding your way through life at a corporate job is your definition of success, then this section is for you. There is only a tiny bit of sarcasm in that sentence…

Your wages are loosely tied to the value of what your contribute to your company. It’s more closely tied to the supply and demand of similar workers as you.

So, to earn more, you have to be better than everyone else around you. To do that you need to:

-

Work harder

-

Work longer

-

Have a skill or knowledge that is hard to replicate

To accomplish this is easy. Work more efficiently and harder than everyone around you. Then, work twice as long as everyone around you.

Do that for 5 or 10 years and eventually your employer will recognize the work you do and you’ll probably make 6 figures. You just need to get there before a younger person is willing to work even harder and longer than you for half the wage.

It’s a bit harder to acquire a skill or knowledge that others cannot replicate, but you could pay for training courses, additional schooling, or study on your own to increase your skills in your field.

Earning $10k Being Self Employed

The benefit to being self employed is that every bit of work you do goes straight back to you.

You do not need to work extra hard and hope that your employer notices and gives you a raise. If you work twice as much, you’ll hopefully see twice as much income (assuming all of the effort you put in generates more revenue).

I think that being self-employed is a great way for people to get started building their income. Everyone talks about investing, but you probably need extra income first before you can start investing.

-

Very flexible schedule

-

High payout on a sale

-

Can be automated, outsourced, or grown organically

The first couple things that come to mind are consulting and real estate.

I like consulting because it is a high payout job and also offers a very flexible schedule. It’s not something that can be totally outsourced, as people expect their consultant to be the one consulting them.

Being a real estate agent is also highly flexible and has a very good payout. It’s also very automatable (is that a word?). Almost every step of the process can eventually be outsourced to an assistant, VA, or other real estate agent.

It also costs very little to get started, has few barriers to entry, and is easy to take market share because most people don’t have an existing relationship with a real estate agent.

Another reason I like the idea of being a real estate agent is because when you do get started investing in real estate, you’ll have a leg up on other people. Hint: this is exactly how I got started in real estate.

Getting Started as a Real Estate Agent

Becoming a successful real estate agent is super simple (though it requires a bit of effort!). Just follow these steps:

- Take your licensing coursework (I like Real Estate Express to fast-track it)

- Take your tests (both state and federal)

- Determine your niche and ideal clients

- Find a good brokerage to hang your license

- Find clients and close deals

Taking Your Real Estate Agent Coursework

Every state has its own licensing requirements. Some are easy while others are hard, so it’s important to get the best coursework that will make you the most likely to succeed.

That’s why I always recommend Real Estate Express. They offer all of your coursework for ridiculously cheap. It’s all set up to get you through the coursework quickly and give you the best chance of passing your test.

Taking Your Tests

There are two tests to take – the federal and the state real estate exam. They aren’t hard, but you do need to prepare for them.

I recommend scheduling the test as soon as you’re done with the course and taking it as soon as possible.

A lot of people schedule it several weeks or months away to give them “time to study” but I don’t think this is generally true. Generally, you know the most the day you complete the course, and every day after that you lose some of it.

So just get it over and done with asap!

Determine Your Niche

There are hundreds of niches to choose from, so be selective and master one or two.

I personally think that being a residential agent for real estate investors is the perfect niche. Here’s why.

Being a commercial broker is really hard, especially for new agents. The top producers have been doing it for years and everyone knows them. Taking market share is next to impossible for a newbie.

Being a retail agent that works with new home buyers is fine, but they are a dime a dozen and setting yourself apart is really hard.

Being an agent for 1-4 unit residential properties, but working exclusively with investors is the perfect mix. You have a good niche that is focused yet broad enough.

Additionally, investors are logical rather than emotional. They also buy on a regular basis (every year or more than once a year), and don’t care what the place is as long as the numbers work.

So, they are far easier to work with and buy more often. The only drawback is they tend to buy less expensive properties, so you need to do more transactions.

Find a Good Brokerage

The key is to remember that you are interviewing the brokerage, not the other way around.

So, shop around to find one that fits your goals and niche in real estate.

Find Clients and Close Deals

Finding clients is tough! It’s especially tough for the newly self-employed.

Fortunately, there is a service called Agents Invest which connects you to your ideal client. Agents Invest has a boat load of active investors who are looking to buy properties.

You just need to contact them and see if it’s a good fit. So go check them out!

How to Earn $10k per Month as a Business Owner

This is really simple.

Step 1 – Start a business.

Step 2 – Grow your business

and… Step 3 – Earn $10k/month.

Alright, it’s not that simple! I’ve started 3 different businesses and there is a lot that goes into running and growing a business.

If you already have a business, there are two ways that I have found to help you grow. The first is to find whats working for you, and double down on that. The second is to find new revenues sources on the fringe of what you’re doing, or through upselling.

Most people that want to grow a business tend to focus on doing more, but that often ends up with earning less.

I recently had a conversation with a mortgage broker. He said the issue with most brokerages is they want to do every type of lending (multifamily, retail, manufacturing, etc). The problem is, they become just like everyone else out there and nothing sets them apart.

They are not an expert at anything.

Instead, by focusing in on one specific type of lending and becoming an expert at it, the business grows faster and earns more.

Now, if you don’t already have a business in real estate you want to double down on, you might want to start one.

Starting a New Business

If you’re going to be investing in real estate, it probably makes sense to have a business in the real estate field too. There will be synergy between the two and it will ultimately help you invest in the future.

There are a ton of different real estate related businesses that you could start. Literally, dozens or even hundreds of niches to choose from.

If I’m choosing to start a new business I want it to have a few basic criteria.

- I want to be able to automate it (though I can do the work myself to start if I choose)

- It should be scalable

- It should be relatively inexpensive to start

While there are a ton of options available, I’d probably choose to start a wholesaling or lead generation business.

I like this because it hits all 3 of my criteria and it also ties in well with real estate investing. Any time I want to buy a property for myself, just take the best leads and keep them for myself rather than sell them.

Here’s how to get started

Determine Your Niche in Real Estate

It’s important to decide what niche you want to be in. Here are a few popular niches:

-

Multifamily

-

Single Family

-

AirBnB

-

Vacation Rentals

There are more, but those are probably the top 4.

It’s important to know your niche so you can tailor your content and lists to this area.

Build Your Funnel

It’s important to figure out how you will generate leads. This is how most wholesalers fail.

Remember, you have to get your name out there and be the first to find the potential seller before others do. That’s why I love using the internet.

Most people go to Google before ever making a buying or selling decision. That’s why if you can rank your website on Google, people will probably find you first!

If you want to be first to find them (by having them come find you) then what you need is a lead generation website.

For that, navigate to Investor Carrot and put your info in on the next page to get a free trial.

You can also read more about building out your Carrot site on this recent article I posted.

Decide What To Do With Your Leads

Once leads start coming in, you’ll need to decide what to do with them.

If you want to chase them down yourself and put deals under contract, great! If not, you can easily sell your leads to wholesalers in the area. That’s what I do.

I think working an agreement with another wholesaler for a profit share is the best way to do it as it requires the least amount of effort for the most return.

Making $10,000 A Month as an Investor

The one we’ve all been waiting for, drum roll please…

Making money as an investor is all about building up multiple streams of passive income. One of the best ways to do that is with real estate.

Every property you buy is another stream of income to add. Every unit, every tenant, it all adds to your goal.

The biggest risk to real estate is the lost revenue during a turnover or eviction. But, as you buy more property, this averages out.

For example, if you have one house you either have 100% occupancy or 100% vacancy. So, you do great some months and terrible in other months.

But if you own 10 units and 1 is vacant, you’ll have 90% occupancy.

If the vacancy rate in your area is 10%, you can expect to always have 1 vacant unit. At this point, it just gets built into your normal operating budget.

Here are the steps to getting started in real estate

Get an Education

The most important part is to learn everything you can about real estate investing. You need to understand how to estimate market value, repairs, rents, your operating budget, etc.

To do this, I recommend this inexpensive eCourse to help you get going.

It’s too easy to make mistakes in real estate, but that shouldn’t stop you from getting started.

Instead, learn from others mistakes first, and the best way to do that is to take their course.

Get an Agent

You don’t need an agent to invest in real estate. If you have build out a lead generation website, then just use those leads to buy deals.

But, if you don’t have any source of leads, the best place to start is with an agent.

For this, I recommend the service Agents Invest, which connects investors to investor savvy agents around the country.

Make Offers

A lot of people don’t ever find a deal because they are afraid to make offers. If a deal is listed too high, simply make an offer for less.

Don’t be scared of making offers!

I once offered less than half of what a property was listed for (and got it). So, it happens. Just recently a good friend of mine negotiated over $150k off a deal that was only listed around $500k to begin with.

That’s a 30% savings!

So, it’s totally possible to do, even in a hot market!

Do a Combination to Earn $10k/month

The last option is to do a combination of the above to get to $10,000 per month.

If you are self employed, own a small online business, and also have some real estate with some passive income, that combination might get you to your goal as well.

Your Turn

What are you doing to reach the goal of $10,000 per month? If your goal is higher or lower, tell me what your goal is and what you’re doing to achieve it.

This article originally appeared on IdealREI. Follow them on Facebook, Instagram and Twitter.

You may like

Real Estate Investing

5 Recession-Proof Investments for Your Portfolio

Published

3 years agoon

May 3, 2023

By Sheryl Chapman

As we all know, the economy can be unpredictable at times. Recession is a common phenomenon that can affect the investments in your portfolio.

But don’t worry, there are some sectors that are likely to perform well—even during a recession. Here are five recession-proof investments that you can consider adding to your portfolio.

(Editor’s note***********:************ If you wanna learn how to start investing for retirement, check out the free lessons inside the academy! 📺)*

1. Consumer staples

Consumer staples are products that are essential to our daily lives, such as food, household goods, and personal care items.

These products are in constant demand, regardless of the economic climate. Companies that produce these items, such as Procter & Gamble and Coca-Cola, are considered recession-proof investments.

These companies have a stable revenue stream that can weather economic downturns.

2. Utilities

Utilities are another recession-resistant investment. People need electricity, gas, and water, regardless of the state of the economy.

Utility companies, such as Duke Energy and American Electric Power, have a steady stream of revenue and provide investors with a reliable source of income.

3. Healthcare

The healthcare industry is recession-proof because it provides essential services that people cannot do without. Companies that provide healthcare services or products, such as Johnson & Johnson and UnitedHealth Group, are likely to remain profitable during a recession.

4. Gold

Gold is a safe-haven investment that many investors turn to during times of economic uncertainty. Gold prices tend to rise during recessions because it is seen as a store of value. Investors can buy physical gold, gold ETFs, or invest in gold mining stocks.

GUIDE: 3 Ways To Invest In Gold In 3 Minutes Or Less 🔑📲

5. Treasury bonds

Treasury bonds are considered to be one of the safest investments during a recession.

These bonds are issued by the US government and are backed by the full faith and credit of the government. Treasury bonds provide a fixed income and are considered to be a low-risk investment.

In conclusion, these five investments are considered to be recession-proof because they provide essential products or services that people cannot do without.

Adding these investments to your portfolio can provide stability during times of economic uncertainty.

Real Estate Investing

5 Tips To Pricing Your Airbnb Listing For Maximum Profits

Published

3 years agoon

May 2, 2023

Airbnb has revolutionized the travel industry by providing an affordable and unique way for travelers to experience different destinations.

With over 7 million listings worldwide, it’s safe to say that Airbnb has become one of the most popular ways for travelers to find lodging.

However, as a host, one of the most challenging decisions you’ll face is determining the right price for your listing.

Pricing your Airbnb listing correctly is critical to your success as a host, as it can make or break your profitability.

Here are some tips to help you price your Airbnb listing for maximum profit:

Know Your Market

Before you set your price, it’s essential to research the market in your area. Look at other listings in your neighborhood, paying attention to the size of the property, amenities, and location. Check the availability of your competitors and the average price they charge. This information will help you determine your pricing strategy and ensure that your listing is competitive.

Consider Seasonal Demand

Seasonal demand plays a significant role in the pricing of your Airbnb listing. During peak seasons, such as holidays, festivals, and major events, you can charge higher rates. Conversely, during low seasons, you’ll need to lower your prices to attract guests. Keep track of events happening in your area and adjust your prices accordingly.

Offer Discounts

Offering discounts is an effective way to attract guests and increase your occupancy rate. Consider offering discounts for extended stays, early bookings, or last-minute reservations. You can also offer discounts to guests who leave a positive review or refer new guests to your listing.

Calculate Your Costs

To ensure that your pricing strategy is profitable, you need to calculate your costs. Take into account expenses such as cleaning fees, utilities, maintenance, and taxes. Factor in your time and effort as well. Your goal is to set a price that will cover all your costs while still allowing you to make a profit.

Be Flexible

Finally, be flexible with your pricing strategy. Test different prices and see how they affect your occupancy rate and profitability. Monitor your competition regularly and adjust your prices accordingly. Remember that the market is constantly changing, and your pricing strategy needs to adapt to stay competitive.

In conclusion, pricing your Airbnb listing for maximum profit is a crucial aspect of your success as a host. By researching your market, considering seasonal demand, offering discounts, calculating your costs, and being flexible, you can set the right price for your listing and maximize your profitability.

Happy hosting!

Real Estate Investing

5 Skyscrapers You Can Own Today With $5 Or Less

Published

3 years agoon

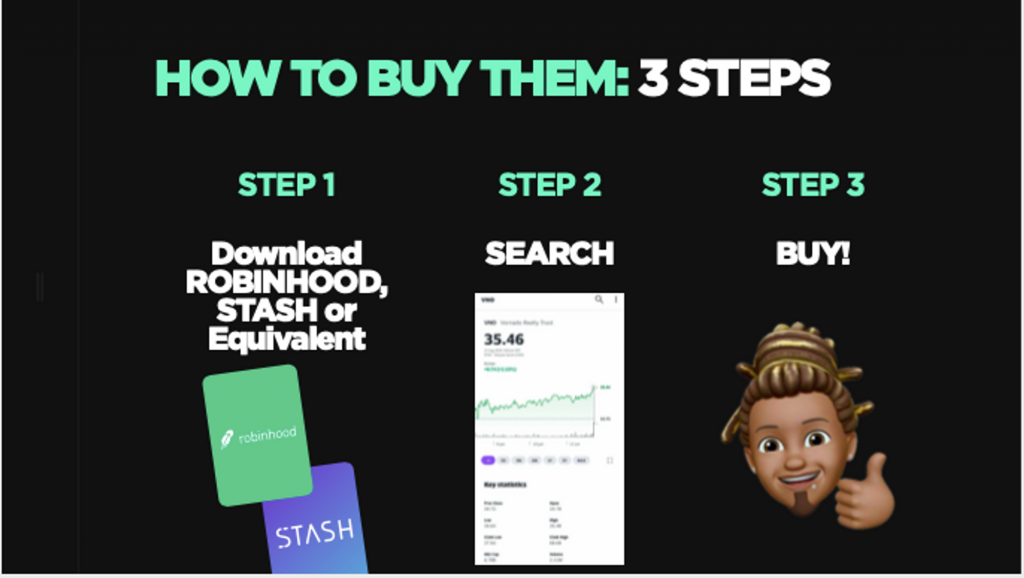

April 28, 20235 REITs that own iconic buildings you can buy today

Real Estate Investment Trusts (REITs) are companies that own and operate income-generating real estate properties.

Investing in REITs has become an increasingly popular way to own a piece of the real estate market without having to buy individual properties.

And you can buy them in the next 5 minutes on the NYCE app…with $5 or less.

Here are five REITs that own iconic buildings across the United States that you can invest in today:

- Empire State Realty Trust, Inc. (ESRT) – ESRT owns the famous Empire State Building in New York City, as well as several other properties in the city.

- Vornado Realty Trust (VNO) – VNO owns the iconic 555 California Street building in San Francisco, which was once the tallest building on the West Coast.

- Boston Properties, Inc. (BXP) – BXP owns several iconic buildings in the United States, including the John Hancock Tower in Boston and the Salesforce Tower in San Francisco.

- SL Green Realty Corp. (SLG) – SLG owns several iconic properties in New York City, including One Vanderbilt, which is currently the fourth-tallest building in the city.

- Macerich Company (MAC) – MAC owns several high-end shopping centers across the United States, including the iconic Santa Monica Place in California.

************************************************************************************************LEARN: How to own real estate with $1000 or less.

Investing in REITs can provide diversification and potentially higher returns than investing in individual properties. However, as with any investment, it is important to do your research and understand the risks involved.

Top 5 Best Investment Strategies To Survive A Recession

The Top 10 Investment Opportunities To Capitalize On During A Recession

3 Gold Mining Stocks To Buy Today 📲

Ad 1

Trending

You’ve reached your free article limit.

Continue reading by subscribing.

Already a subsciber? Login >

Go back to Homepage >

You must be logged in to post a comment Login