(Editor’s note: “Battle Of The Stocks” is a weekly article series where AJ, our resident Wall Street expert, picks two popular stocks in an industry and see how they match up. In this week’s edition, AJ takes a look at two music industry disruptors in Spotify and Pandora.)

We’re nearly a month away from the earnings season, but it’s never too early to gauge performance and scope out stocks with potential to surprise Wall Street and beat estimates.

This time around we compare two publicly traded stocks that are behemoths in the music streaming industry. Who do they match up? Who’s in the lead? And who’s going to take the win?

We’re about to find out. Let’s get ready to rumble.

Pandora vs. Spotify

Pandora [P] and Spotify [SPOT] are global leaders in the music streaming space. There is, however, a difference in the way these companies function.

Spotify members can choose the tracks they want to listen to and when to play them. Pandora is a radio service where users can create a radio station based on their personal choice of music, artists and songs.

While Pandora Premium is available for $9.99 per month and $109.89 annually, Spotify Unlimited is a tad cheaper on the pocket — subscriptions start at $9.99 a month or $99 a year.

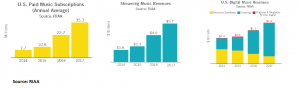

The US music industry has grown from $1.8B in 2014 to $5.7B in 2017. This has unlocked significant opportunities for companies to capitalize on this growth and drive revenue.

Which one is a better stock at current levels? Let’s find out.

Market Value

After going public in early 2011, Pandora has grown to capture a market cap of $2.56B. Pandora’s share price has declined from $13.40 post IPO to its current price of $9.62.

Although the shares touched an all-time high of $37.42 in February 2014, its value has since decreased, eroding massive investor wealth. Surprising many, this year Pandora’s stock is up almost 100%.

On the other hand, Spotify enjoys a much larger market cap of $31.5B. Spotify was publicly listed on April 3, 2018, and closed trading at $149.01. Shares have since risen to its current price of $175.52.

Revenue Growth

Yes, profits are where it’s at. But without revenue, you don’t have much of a business. So which one is raking in more dough?

In 2017, Spotify grossed $4.78B. Spotify’s revenue is expected to grow by 28% year-over-year to $6.12B in fiscal 2018.

By comparison, Pandora grossed $1.47B in 2017 and expects revenue to rise by 5.6% in 2018 to $1.55B, and nearly 12.5% next year.

WINNER: Spotify

Profitability

Spotify and Pandora are still loss-making companies. But with the RIAA (Recording Industry Association of America) highly optimistic about the radio industry, investors will be hoping that the two firms can improve bottom line drastically sooner rather than later.

Moreover, analysts expect Spotify to turn profitable by the end of 2020. Pandora, however, is estimated to report a net loss margin of around 8.4% by 2020.

WINNER: Spotify

Earnings Growth

We’ve seen that Spotify’s profitability is slated to improve at a much higher rate compared to that of Pandora. Spotify’s earnings per share (EPS) is expected to rise 52.5% in 2018 and over 78.5% next year.

Pandora is also expected to improve earnings by 25% this year and around 50% next year, numbers that could cheer investors.

WINNER: Spotify

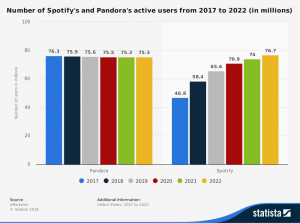

Subscribers

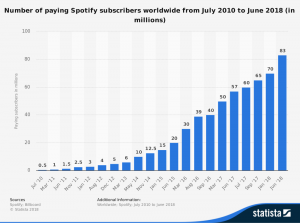

While the above chart shows the active user growth for Pandora and Spotify, we need to consider the number of paid subscribers for both companies.

At the end of Q2 2018, Pandora had just over 6 million paying subscribers. Compare this with Spotify, that has 83 million paid subscribers — Spotify is a strong winner here.

WINNER: Spotify (4-0)

Wealthlab Verdict:

Overall, with a score of 4-0, Spotify wins this battle easily. Though Spotify is a much larger company in terms of market cap, revenue, and subscribers, it is still able to grow sales at a much faster rate compared to Pandora.

A larger subscriber base leads to higher revenue and increased spending for sales and marketing. This results in converting potential customers and is a virtuous cycle that Spotify has taken advantage of.

You must be logged in to post a comment Login