In our fourth edition of the Battle Of The Stocks, we size up two domestic gaming giants: Electronic Arts [EA] and Activision Blizzard [ATVI]. These behemoths account for a significant portion of the gaming market share in the United States.

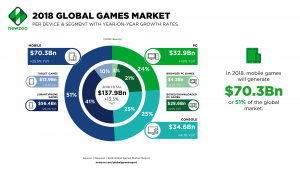

The United States’ gaming market has been valued at $30.4B in the trailing 12 months prior to June this year. Comparatively, EA has reported sales of $5.1B while ATVI has sales of $7.2B in the same period. These two firm’s accounted for over 40% of total gaming revenue in the United States.

EA and ATVI have created significant investor wealth over the past few years. Activision Blizzard’s shares have generated absolute returns of 340% while EA stock has risen 348% in the last five years.

But historical gains are not an indicator of future performance. Let us look at the key financial metrics between the two companies and compare them to see which is a better buy at current levels.

Market Cap

Driven by the massive increase in share prices, the market cap or market value of Electronic Arts and Activision have gained significantly over the last few years.

Shares of EA have risen 57% over the last three years and is up 4.2% this year. Comparatively, the ATVI stock has gained 133% in the last three years and up 48% in 2018.

EA’s market cap is currently $33B while Activision’s market cap is higher at $59B.

Revenue Growth

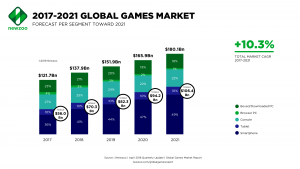

Revenue growth is a key indicator to gauge the financial position of any company. Any firm that can grow its revenue will be worth investing in. EA reported sales of 5.18B in fiscal 2018. Analysts expect EA’s revenue to grow 1.9% to $5.28B next year, 9.7% to 5.8B in 2020 and 6% to $6.12B in 2021.

Activision Blizzard reported sales of $7.16B last year. According to analysts, the company is estimated to grow sales by almost 7.4% in 2020.

WINNER: Activision Blizzard

Profitability

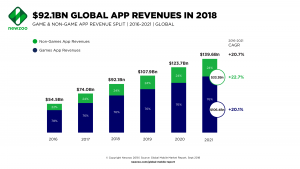

The significant rise in digital and mobile gaming has driven profit margins of companies higher. The high gross margin translates into robust bottom-lines for companies.

EA’s operating margin is expected to be 35% in 2019. ATVI’s estimated profit margin is estimated to be higher at 36% in 2019.

WINNER: A Tie

Earnings Growth

While the two companies are looking to improve profit margins, analysts and investors are concerned over the earnings growth potential.

Analysts expect EA’s earnings per share (EPS) to grow 14.3% over the next five years. Comparatively, analysts expect Activision’s earnings to rise 15.2% over the next five years.

WINNER: Activision Blizzard

Analyst estimates

We have looked at key financial metrics for the two stocks. Let us now see what Wall Street analysts expect from the two companies. Analysts have a 12-month average target price of $141.15 for EA, indicating an upside potential of 29%.

Comparatively, analysts expect ATVI’s share price to rise to $81.11, providing an upside potential of 4.5% over the next year.

WINNER: Electronic Arts

The scorecard is slightly in favor of Activision at 2-1. However, with the gaming industry set to experience revenue growth over the next few years, both the companies are likely to benefit.

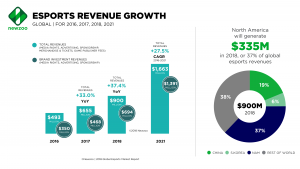

Activision pips EA slightly with its extensive gaming portfolio and expertise in eSports. Activision Blizzard, in fact, created the first competitive global eSports league earlier this year.

Wealthlab Verdict: Activision Blizzard (2-1)

You must be logged in to post a comment Login