Small-cap stocks are generally an ideal investment for investors which a high-risk appetite. Small-cap stocks have a market capitalization of under $3B.

These companies provide a higher rate of return as they are generally driven by high growth prospects. These shares are also more volatile compared to mid-cap or large-cap stocks.

The Vanguard Small Cap ETF [VB] which is a broad indicator of the small-cap space, declined over 3.3% last week. Here we look at small-cap stocks that underperformed the market significantly in the first month of Oct. 2018.

GoPro

GoPro [GPRO] shares fell 13% last week to close trading at $6.26. The stock has burnt significant investor wealth over the last two years due to a decline in product shipments.

GoPro launched the highly anticipated Karma drone two years back but had to recall shipments shortly after the product launch. The company then decided to discontinue the production of Karma and exited the drone market.

Earlier this year, GoPro has launched several products across price points to target different customer segments. It will be interesting to see if this will improve device sales and result in revenue growth for the company.

Market Cap: $931.5M

Year-to-date Return: -17.3%

Last week decline: $139M

Windstream

This telecom company has had a horrendous run in the last two years. Windstream [WIN] shares have declined 51% this year after slumping 76% in 2017. The stock declined 8.2% last week.

Some analysts believe the rising debt levels of Windstream might drive the firm to bankruptcy. Earlier this year, Michael Rollins from Citigroup [C], reduced Windstream’s price target to $1.

According to Rollins, Windstream is in a “precarious operating position and faces rising financial risks.”

Market Cap: $193.2M

Year-to-date Return: -51.35%

Last week decline: $17M

Frontier Corp.

Similar to Windstream [WIN], Frontier Corp. [FTR] continues to underperform the markets significantly. The stock is up marginally by 0.7% this year. It has however declined 22% in 2016 and 87% last year. Shares fell 5% last week.

The company has been impacted severely by subscriber losses and falling profitability. FTR purchased Verizon’s [VZ] CTF (California, Texas and Florida) assets for $10.54B way back in 2016.

Though this initially resulted in cost savings, the cord-cutting phenomenon coupled with the demand for a cable-based internet impacted the company’s revenue.

FTR has to discontinue its dividend payouts and impose a reverse stock split to continue trading on NASDAQ.

Market Cap: $720.57M

Year-to-date Return: -0.74%

Last week decline: $37M

Pandora

Shares of music streaming company, Pandora [P] declined close to 6% last week. In the last week of Sept., the stock rose 4.6% as Sirius XM [SIRI] announced its intention to acquire Pandora for $3.5B.

Pandora shares have had an impressive run in 2018, as the stock has risen close to 86%.

Market Cap: $2.41B

Year-to-date Return: 86%

Last week decline: $140M

Fitbit

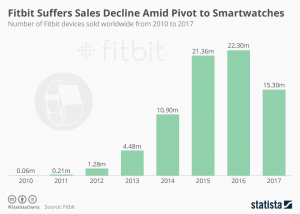

Fitbit [FIT] too has burnt significant investor wealth in the last two years. This stock fell 73% in 2016 and 25% in 2017. Shares have slipped close to 12% in 2018 as well.

Fitbit shares were recently impacted by the launch of the Apple Watch Series 4. The company’s shares have declined driven by Fitbit’s loss in the wearable market. Fitbit shipments have fallen in a growing wearable space.

The company has struggled to compete against Apple [AAPL], Garmin [GRMN], Xiaomi and Fossil [FOSL].

Market Cap: $1.24B

Year-to-date Return: -12%

Last week decline: $70M

You must be logged in to post a comment Login