Real Estate Investing

Real Estate: Is It In A Bubble?

Published

7 years agoon

I originally wrote this article 6 months ago but the same question applies so I’m updating and improving it. The question still applies, is real estate at a bubble? Is it at the top?

I was at the bar for a friend’s going away party and a random guy at the bar started telling me how I needed to buy some new coin. Not Bitcoin, he said, but some other coin he had discovered that is going to make you rich.

In fact, he had just quintupled his money since this morning. I needed to hurry up and get in on the action!

…When the local regular at a small bar in small-town USA has finally started giving investing advice, it’s time to move on to the next big thing. So, I’m done with cryptocurrency (until it collapses).

Mind you, I wrote those words back when Bitcoin was was reaching new highs every day (it’s since lost 90% of it’s value)

But, What About Real Estate?

Ten years ago when I got started in real estate, everyone thought it was a terrible idea.

“If it was so easy everyone would do it.”

“Don’t you think real estate is too risky?”

You know the lines. I heard them all. But now, real estate is the best investment on the planet.

A huge number of friends and also former co-workers of mine have jumped into real estate investing within the last year. People who used to warn me how dangerous real estate was are now telling me real estate is probably the best thing to get into (except cryptos, of course!).

It’s the “best” because their best friend’s, uncle’s, nanny just house-hacked a home and earned $50k and quit being a nanny and is now a full-time house flipper!

Or…someone they knew bought a house 3 months ago and already sold it for $20k profit!

Maybe…their friend’s nephew just became a landlord though he’s 19 and doesn’t really even have a stable job (so he’s technically “retired”, right?).

The Vibe in Real Estate

If you’re getting this feeling or this vibe with any sort of investment, you need to be very cautious. Every time I’ve seen it, it’s been bad.

I turned 18 in 2003. Though I was young, I remember the boom years – I was 16 and everyone was offering me part time work at $10-$12 per hour to do construction work that I had no idea how to do.

When I was 18, 19, and 20, I was remodeling apartments at $10-$15 per hour though I had basically no experience.

Everyone was making money and throwing it around. Then I graduated college in 2008 and the economy collapsed.

It was the same feeling with cryptos. Everyone was excited about them, now I never hear about them anymore.

…and now, everyone I know has become real estate investors.

Real Estate & Economic Fundamentals

When your gut tells you something, you need to pay attention. But, I question myself at the same time.

Housing inventory is chronically low which is forcing housing prices to go up. House construction simply can’t keep pace with demand and the same is true with apartment developments.

Interest rates are dampening demand. If interest rates continue to rise, it could affect the entire economy, but the Fed has signaled it might slow or stop their interest rate increases.

The economy is great, unemployment is rock bottom, real estate prices are increasing. New wealth has been created by the trillions in the last year or two.

Stocks are going through a correction, but stock prices are not an economic indicator. If they get too low it can change people’s perceptions of the economy though and reduce spending. So, we need to pay attention to it.

Wages are growing faster than inflation for the first time in decades.

But, cap rates are amazingly low and property prices are ridiculously high compared to the income being produced. This means people prefer real estate over other investments.

Economists are constantly revising up their estimates for growth.

But… the yield curve inverted, at least on part of the curve, which usually signals an upcoming recession within 1-2 years.

So, which is it? Is real estate at the top or are economic indicators showing strong fundamentals?

Is it Rational or Irrational Exuberance?

Well, my crystal ball is as clear as yours. No one can predict the future but here’s my take.

I don’t feel that all signs point to bubble yet because there is enough conflicting thoughts to make me believe we aren’t quite there yet. Real estate is cooling down, but a lot of that is due to interest rates. If they don’t continue to rise, then real estate should be more stable or continue to rise.

For now, though, all we can do is to plan and to prepare. Here are your options.

Joining The Herd.

Most people invest a lot and take risks when times are great, but pull way back when times are bad. They dump $50k into stocks then when they drop 20%, they immediately sell to protect them from further losses.

Then once stocks have dropped 40%, they are too scared to reinvest until stocks are back up or higher than where they were before.

People jump into bitcoin when it’s 15,000, ride it to 17,000, then dump it when it gets to 10,000.

This is the herd mentality and is the absolute wrong way to invest.

Back in 2007, they were giving loans to anyone with a pulse but by 2011 it was basically impossible to get financing, even though housing was at rock bottom prices.

When properties could be bought for literally 40 cents on the dollar, nobody was lending and nobody was buying.

Bucking The Herd…

The hardest part of doing the opposite thing is you’ll have some serious FOMO (fear of missing out).

I know people who have made $200k+ in cryptos. FOMO was taking hold of me and I almost I actually invested $1,000 into bitcoin right around $15,500. I played with it for a week or two and sold it, losing roughly $3. That is not a typo.

I did it for fun because investing due to FOMO is the absolute worst reason to invest. A lot of people put a ton of money into it right at the wrong moment.

Instead, I believe people should invest when times are great and invest way more when times are bad. Also, I only want to invest in well known and historically good investments. In a way, it’s like dollar cost averaging.

Using the above example, if the market is hot, I wouldn’t dump all $50k into the market. Instead, I might dump $20k and leave $30k cash. As the market drops, I keep buying more. If it goes up, I buy more too, just more slowly.

In fact, this is almost exactly what I did during the market crash after Lehman Brothers collapsed. I invested my life savings in the beginning of september 2009 and lost half 2 weeks later.

I was somehow able to make all my money back within about 6 months because of dollar cost averaging.

Dollar Cost Averaging Works in Real Estate

The fact is that nobody knows when we will be at the top and nobody knows how hard the market will correct when we get there. It could come in 3 years or it could come tomorrow.

3 years ago I knew a person who sold a lot of their multifamily because they said we are at the top. 3 years later they lost out on a ton of money because it’s still going strong.

So, if you held back your investments today, you could lose 3 more years of a bull market.

My point is, I wouldn’t avoid buying. Just buy a deal or two, buy them right, and focus on adding serious value to keep you above water when the market corrects.

During a correction, use your capital reserves to really get in and buy as many properties as possible with as little money as possible. Don’t focus on adding a lot of value, just focus on getting them cash flowing.

Adding value means typing up capital. Tying up capital means buying fewer properties for huge discounts.

So, save those improvements for when the market is hot and deals are hard to find.

How Are You Planning to Invest in the Next Few Years?

Are you following the herd and diving in, or are you bucking the herd and doing the opposite.

This article originally appeared on IdealREI. Follow them on Facebook, Instagram and Twitter.

You may like

Real Estate Investing

5 Recession-Proof Investments for Your Portfolio

Published

3 years agoon

May 3, 2023

By Sheryl Chapman

As we all know, the economy can be unpredictable at times. Recession is a common phenomenon that can affect the investments in your portfolio.

But don’t worry, there are some sectors that are likely to perform well—even during a recession. Here are five recession-proof investments that you can consider adding to your portfolio.

(Editor’s note***********:************ If you wanna learn how to start investing for retirement, check out the free lessons inside the academy! 📺)*

1. Consumer staples

Consumer staples are products that are essential to our daily lives, such as food, household goods, and personal care items.

These products are in constant demand, regardless of the economic climate. Companies that produce these items, such as Procter & Gamble and Coca-Cola, are considered recession-proof investments.

These companies have a stable revenue stream that can weather economic downturns.

2. Utilities

Utilities are another recession-resistant investment. People need electricity, gas, and water, regardless of the state of the economy.

Utility companies, such as Duke Energy and American Electric Power, have a steady stream of revenue and provide investors with a reliable source of income.

3. Healthcare

The healthcare industry is recession-proof because it provides essential services that people cannot do without. Companies that provide healthcare services or products, such as Johnson & Johnson and UnitedHealth Group, are likely to remain profitable during a recession.

4. Gold

Gold is a safe-haven investment that many investors turn to during times of economic uncertainty. Gold prices tend to rise during recessions because it is seen as a store of value. Investors can buy physical gold, gold ETFs, or invest in gold mining stocks.

GUIDE: 3 Ways To Invest In Gold In 3 Minutes Or Less 🔑📲

5. Treasury bonds

Treasury bonds are considered to be one of the safest investments during a recession.

These bonds are issued by the US government and are backed by the full faith and credit of the government. Treasury bonds provide a fixed income and are considered to be a low-risk investment.

In conclusion, these five investments are considered to be recession-proof because they provide essential products or services that people cannot do without.

Adding these investments to your portfolio can provide stability during times of economic uncertainty.

Real Estate Investing

5 Tips To Pricing Your Airbnb Listing For Maximum Profits

Published

3 years agoon

May 2, 2023

Airbnb has revolutionized the travel industry by providing an affordable and unique way for travelers to experience different destinations.

With over 7 million listings worldwide, it’s safe to say that Airbnb has become one of the most popular ways for travelers to find lodging.

However, as a host, one of the most challenging decisions you’ll face is determining the right price for your listing.

Pricing your Airbnb listing correctly is critical to your success as a host, as it can make or break your profitability.

Here are some tips to help you price your Airbnb listing for maximum profit:

Know Your Market

Before you set your price, it’s essential to research the market in your area. Look at other listings in your neighborhood, paying attention to the size of the property, amenities, and location. Check the availability of your competitors and the average price they charge. This information will help you determine your pricing strategy and ensure that your listing is competitive.

Consider Seasonal Demand

Seasonal demand plays a significant role in the pricing of your Airbnb listing. During peak seasons, such as holidays, festivals, and major events, you can charge higher rates. Conversely, during low seasons, you’ll need to lower your prices to attract guests. Keep track of events happening in your area and adjust your prices accordingly.

Offer Discounts

Offering discounts is an effective way to attract guests and increase your occupancy rate. Consider offering discounts for extended stays, early bookings, or last-minute reservations. You can also offer discounts to guests who leave a positive review or refer new guests to your listing.

Calculate Your Costs

To ensure that your pricing strategy is profitable, you need to calculate your costs. Take into account expenses such as cleaning fees, utilities, maintenance, and taxes. Factor in your time and effort as well. Your goal is to set a price that will cover all your costs while still allowing you to make a profit.

Be Flexible

Finally, be flexible with your pricing strategy. Test different prices and see how they affect your occupancy rate and profitability. Monitor your competition regularly and adjust your prices accordingly. Remember that the market is constantly changing, and your pricing strategy needs to adapt to stay competitive.

In conclusion, pricing your Airbnb listing for maximum profit is a crucial aspect of your success as a host. By researching your market, considering seasonal demand, offering discounts, calculating your costs, and being flexible, you can set the right price for your listing and maximize your profitability.

Happy hosting!

Real Estate Investing

5 Skyscrapers You Can Own Today With $5 Or Less

Published

3 years agoon

April 28, 20235 REITs that own iconic buildings you can buy today

Real Estate Investment Trusts (REITs) are companies that own and operate income-generating real estate properties.

Investing in REITs has become an increasingly popular way to own a piece of the real estate market without having to buy individual properties.

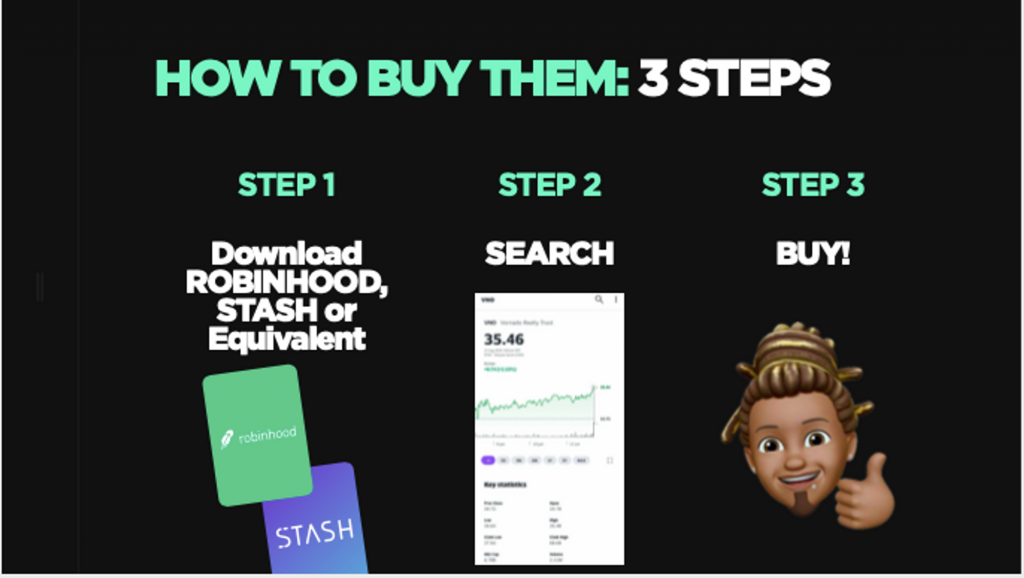

And you can buy them in the next 5 minutes on the NYCE app…with $5 or less.

Here are five REITs that own iconic buildings across the United States that you can invest in today:

- Empire State Realty Trust, Inc. (ESRT) – ESRT owns the famous Empire State Building in New York City, as well as several other properties in the city.

- Vornado Realty Trust (VNO) – VNO owns the iconic 555 California Street building in San Francisco, which was once the tallest building on the West Coast.

- Boston Properties, Inc. (BXP) – BXP owns several iconic buildings in the United States, including the John Hancock Tower in Boston and the Salesforce Tower in San Francisco.

- SL Green Realty Corp. (SLG) – SLG owns several iconic properties in New York City, including One Vanderbilt, which is currently the fourth-tallest building in the city.

- Macerich Company (MAC) – MAC owns several high-end shopping centers across the United States, including the iconic Santa Monica Place in California.

************************************************************************************************LEARN: How to own real estate with $1000 or less.

Investing in REITs can provide diversification and potentially higher returns than investing in individual properties. However, as with any investment, it is important to do your research and understand the risks involved.

Top 5 Best Investment Strategies To Survive A Recession

The Top 10 Investment Opportunities To Capitalize On During A Recession

3 Gold Mining Stocks To Buy Today 📲

Ad 1

Trending

You’ve reached your free article limit.

Continue reading by subscribing.

Already a subsciber? Login >

Go back to Homepage >

You must be logged in to post a comment Login