Real Estate Investing

Not A Citizen? Here’s How to Invest In US Real Estate.

Published

7 years agoon

Everyone wants to buy US real estate because of the regulatory environment, stability, and economic growth. But, many people pass it over.

The number 1 reason people don’t invest in real estate is the perceived risk of it. That could come from a number of factors, but often it’s because you don’t live geographically near the property you want to buy.

Another reason might be that you aren’t a citizen of the country you want to make the purchase in. This is incredibly common for people who want to invest in the US but live abroad or are citizens of other countries.

Sure, it sounds like a great idea, but how are you going to buy and manage something on the other side of the planet in a country you don’t really know?

But, did you know that it’s not hard to invest in US real estate even if you live abroad and are a citizen of another country?

Sure, there are some considerations you have to make and hoops to jump through, but it’s totally doable.

Why US Real Estate?

Once you’ve decided to invest in another country, you need to ask “why invest in US real estate” and not somewhere else. As a real estate investor you don’t want to limit your options.

Well, recently the US real estate sector has separated itself from other sectors in the US as well as from real estate in other countries.

The financial crisis is in the rear view mirror and the US economy is fueled by strong business and job growth. The US has a very stable real estate market and mature capital markets which compare positively to other countries.

Europe, being its most comparable area, has been embroiled in one economic crisis after another from Greece to Italy to Spain. Brexit, and strain on the welfare state from migration are just the most recent which can seen with widespread protests in France.

From a more micro perspective, US real estate has a lot of mature cities that have a lower cost than in many international cities such as London or Tokyo. While the US does have very expensive markets such as Los Angeles or New York City, there are a lot of core markets that offer good returns at a lower price point.

Additionally, the U.S. market is more liquid than other markets around the world and much more massive. So, it’s comparatively easy to sell and reinvest your capital somewhere else should your personal situation change or should economic conditions dictate your need to sell.

While there are a lot of great reasons to invest in the US, there are a lot of hurdles as well.

Hurdles You’ll Face as a Foreign Buyer of US Real Estate

It easiest for U.S. Citizens and permanent residents to purchase US real estate. Foreigners have a more difficult time and have more hurdles to overcome. So, let’s talk about all the drawbacks you will face as a foreign buyer of US real estate.

No Fannie Mae and Freddie Mac

In the residential real estate market (1-4 units), Fannie Mae and Freddie Mac are the king of the home loan. Basically, they guarantee or purchase the majority of home loans so when they set standards, most banks and lenders follow suit. Unfortunately, they do not purchase loans from non-US citizens.

So, these are not an option for foreign buyers. You’ll have to focus on finding lenders that keep the loans on their own books and don’t sell them to Fannie or Freddie.

The problem for banks is that these loans are harder to sell on the secondary market. Foreigner buyers have a higher risk of default and it’s more difficult to collect unpaid balances if they live overseas. So, you will have a harder time qualifying and pay higher interest and fees to offset the risk they face.

Mortgages to Foreign Buyers Have Higher Interest

There are plenty of banks that will lend to a foreign national who lives outside of the United States, but they have to create loans that don’t conform with Fannie or Freddie guidelines and have to keep them on their own books.

So, they charge higher interest and higher processing fees.

They will also require a larger down payment to give them some more room in the chance that you default. Often they will require 30% or more as the down payment.

Generally, a bank looks at your income, your expenses, and your credit history to determine if you are qualified for a loan. For foreign buyers, it’s a lot more difficult for them to verify these things.

So, they will ask for a lot more documentation than they would ask of an American real estate buyer. This may include tax returns, bank statements, and any credit history available in your home country. They may require several months worth of bank statements, credit statements, and a huge variety of other documents, all of which is just to make them feel more comfortable extending a mortgage to you.

Because of all this extra underwriting, it will take longer for your loan to go through and finish processing.

To speed this up, you might want to apply for a loan at a bank in your home country that also does business or has a presence in the US. The bank will be able to verify your information more easily, but also extend credit in the US.

Fannie Accepts Green Cards or Work Visas

Fannie backed loans or FHA accept work visas. So, if you happen to be in the US, even for a short period of time, you may be able to qualify for one of these.

There may be some additional documentation requirements, but having FHA or Fannie backed loans will open a lot of doors, lower your cost and down payment requirements.

How to Invest in U.S. Real Estate

We’ve covered all the reasons to invest in the US and also all the difficulties you’ll face when trying to get a loan. Now it’s time to cover some basic information to help you get started as a foreign real estate investor buying US real estate.

The first thing to consider is what niche in real estate you want to get into.

Residential vs Commercial Real Estate

For some reason, residential real estate is considered any building with 4 or fewer living units in it. It is not exclusive to single family homes or condos which is great for investors if you want to get into small multifamily!

5 units and above multifamily is considered commercial, even though it’s residential living space. Also, all commercial office space, retail, etc is considered commercial real estate. This includes single occupancy buildings such a standalone pharmacy or restaurant.

The biggest difference to know about is how the price of real estate is determined. Residential real estate is based entirely on comparable sales and you can estimate the price based on a comparative market analysis. Conversely, commercial property is based entirely on the net operating income and capitalization rates in that market.

For residential property, to improve the value you need to improve the condition as compared to other similar properties in the area.

For commercial real estate, to increase the value you need to increase the income or lower the operating expenses.

It’s important to understand the difference between the two before choosing a niche. Each has it’s pros and cons and I invest in both types of real estate. But, you need a different approach depending on the type of real estate you choose.

Creating an Entity

Before you start shopping, you need to know how you will take ownership. If you are shopping for residential property, you will probably buy it using your own name. If you are buying commercial property, you will most likely need an entity to take ownership. This could be an LLC or Corporation.

Fortunately, foreigners can set up an LLC and the process is very simple.

The reason why creditors might want you to take ownership inside an entity is to protect the asset from liability elsewhere in your portfolio. Each LLC is a unique entity and the debts and liabilities in one are shielded from debts and liabilities in another.

So, if you do something silly in one property and a tenant gets hurt and sues, your other assets in separate LLCs are mostly shielded from this lawsuit.

The costs are slightly higher to own and operate a company, but the asset protection is well worth it both for you and for the lender.

Pick a Market

The US is massive and has hundreds of cities to choose from. You’ll need to pick one and focus on it if you want to have any chance of ever picking an actual property to purchase.

There are dozens of factors you might want to consider, but you’ll want to narrow it down to a few big factors first, then keep narrowing it down from there.

At first, you’ll want to consider the following major items:

Population Growth

You want to buy into a metro area and state that have positive population growth. This shows you that people want to live here and will move here from other places

Job Growth

You want to see new businesses opening and moving here from other areas. This shows the state and population have what businesses want – smart, educated, and hardworking employment base.

Employer Diversity

Generally, you don’t want to buy into a city that derives most of its jobs from one source. Good examples might be mining, oil, tourism, shipping, etc. If the majority of workers are employed in one industry, and the rest of the employment supports that industry, then you are set up for big problems if there is any issue in that industry.

Building Your Team

Once you’ve got all the admin stuff out of the way such as qualifying for a loan and establishing your entity, you’ll want to build a team in the city you will purchase in. Before you start looking for property, you will want to build your team.

You’ve already built some of your team, but there are still others you need to find. You should have already found a mortgage broker/lender, but now you need a good property manager, real estate broker in your target city, insurance agent in the target state, and contractors as well as inspectors.

You’ll need each one at some point and it’s good to build relationships with them before you actually start searching for property and need them. This way you won’t be scrambling around at the last minute.

But, be mindful of their time. You don’t want to take up a ton of their time asking questions when you have no business to offer them yet.

Searching For a Property

It’s finally time to start searching for property. If you’re looking for residential property, your agent will provide you suggested listings or set you up on an automated service that delivers listings to your email.

Commercial real estate is a bit trickier and will require you to know several brokers as well as use a service such as costar or LoopNet. In general, if you are buying commercial real estate, you need to get on the email list of the commercial brokers. So, you’ll need to call them all and ask to be on their distribution list.

Making Offers

Don’t be scared to make offers! Determine the value to you and make an offer based on that. If you are under the asking price, that’s OK. If you are over, that’s OK too.

The key is to make sure you get accurate financial information before making an offer. If possible ask for tax schedules or a trailing 12 month profit and loss statement. Smaller properties often don’t have these details so you’ll have to guess a bit more.

Next, take your numbers and put them into a real estate calculator so you know the cash on cash and overall return on investment. Once you know your returns and offer price, contact your broker and they’ll walk you through the process to making an offer.

Doing Diligence

Real estate is all about making assumptions then verifying those assumptions through diligence. In other words, it’s about taking risks then mitigating those risks.

What I mean by this is that you don’t have all the information available to you when you are putting together an offer. Sure, you’ve seen the general condition, some tax information, and rent roll/expenses, but you haven’t seen every unit, talked to every maintenance person, know your interest rates, etc.

Once your offer is accepted, you need to go through every line item and verify it’s accuracy. If it’s inaccurate, you need to adjust your calculator with the new information.

Once you’ve adjusted every item, you need to go back and consider if the deal still works for you or not. Don’t be afraid to back out at this point, but don’t get upset over small differences either.

At a minimum, you will want to verify the:

-

Total Income

-

Operating Expenses

-

Overall Condition

-

Upfront Cost of Repairs

-

Cost of Insurance

-

Property Taxes

-

Property Management

-

Current Rents

-

Potential Rents

It seems like a lot, but that’s why you’ve built a team. Each one of those people will help you verify a piece of information that will help you make a good buying decision.

One Thing About Banking

To help avoid financial crime, there is a law in The United States called the “know your client” law which requires the bank to know who they are working with. In general, someone at the bank needs to know you in some capacity. This could be with an ID and an in person conversation, or it could be more or less.

Some banks allow you to do everything electronically. They may require you to fax or email copies of your ID or talk to them on the phone to establish that relationship.

Another way to open a bank account and work within the law is to establish a US account with a bank that operates or has a partnership in your home country as well. You can open the bank account in the US but verify your identity while being overseas.

Another way to avoid this hassle is to hire a property manager and just pay the costs of an international wire fee every quarter. They can collect your rents, pay your bills, and wire the profits to you every 3 or 6 months.

Income Taxes

They say only Death and Taxes are certainties in life. In other words, the IRS always collects what’s due to it, so don’t try to avoid it. It’s better just to understand the requirements and do it.

Taxes are complicated, and they can be especially complicated with real estate because the tax laws of more than one country might apply. This is because different nations have different tax treaties with the U.S., so it’s really important to consult with a tax expert in your country as well as one in the U.S. to understand everything and make sure you are in compliance.

No treaty allows you to avoid taxes in the US, but some treaties allow you to pay just taxes in the United States. Other treaties require you to pay taxes in both the US and your home country. Additionally, the tax rates may vary depending on your nationality.

So, read the treaties, understand them, and consult with a tax professional or two.

Tax Benefits to Real Estate

In the US, real estate has some of the best tax benefits of all. You can offset the vast majority of your income and often pay little to no taxes for at least 10-15 years.

This is because the U.S. tax code allows deductions for mortgage interest, depreciation, all repairs and maintenance, property taxes, and more.

Often, you can find yourself with a ‘negative income’ on paper even though you collected rent all year long and have a profit. You can carry those ‘losses’ forward to the next year and offset even more profits.

The only catch is the IRS will capture these taxes back when you sell. They’re pretty smart over there at the IRS and know that you’ll defer most profits until sale, so all foreign owners of real estate will have an automatic 10% of the sale price withheld by the IRS until taxes are filed.

Don’t worry, they will refund the difference if you overpaid, but you will also owe any difference if that 10% wasn’t enough to cover your taxes.

Other Ways to Invest in Real Estate

There are a lot of nuances to know and it can seem overwhelming. Nothing we laid out is any more challenging than investing anywhere else in the world (in fact, it’s probably easier in the US than elsewhere). But, if owning your own property is too difficult, there are other ways to have real estate in your portfolio without actually purchasing any physical property.

Real Estate Crowdfunding

Around the year 2014 real estate crowdfunding came alive. Crowdfunding is where you can pool smaller amounts of funds together with other investors to purchase real estate.

In general, you need to have a US based entity with a local bank account. That’s because the deal sponsors don’t want to withhold 10% of the value upon sale to meet the IRS requirements for withholding.

So, create your LLC and set up your bank account and you can invest in real estate via crowdfunding.

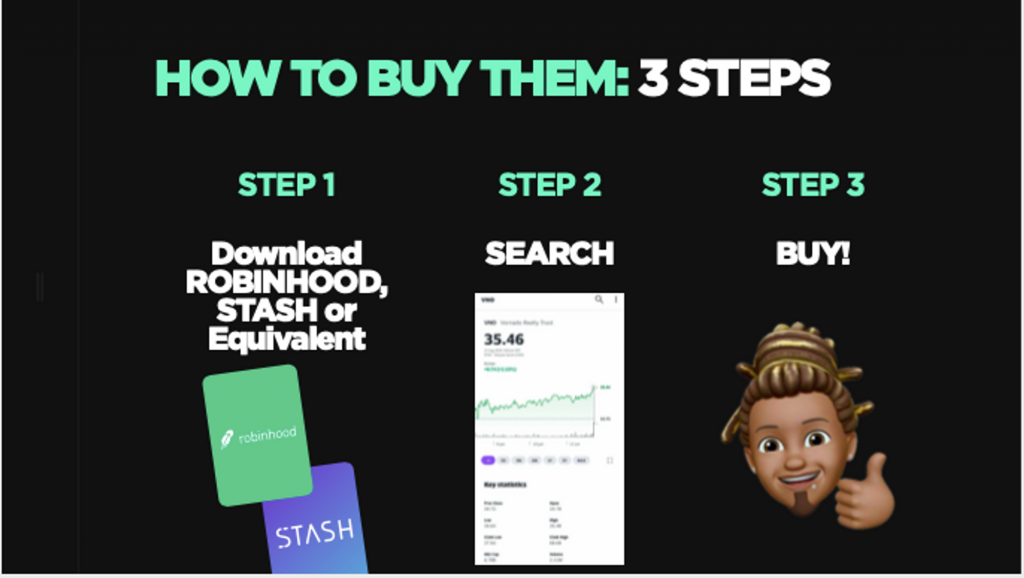

ETFs and REITs

Another way is to buy into Exchange Traded Funds or Real Estate Investment Trusts via the stock exchange. These are generally traded on the open market and you’ll need to meet the requirements that all foreign investors in stocks need to meet.

You’ll be buying a fund that invests in real estate without having the purchase the real estate for yourself. You won’t earn as much because of the management fees they charge, but you also won’t have to jump through all the hurdles of buying real estate.

Private Lending

There are few laws about conducting business in the US as a foreigner. As long as your company is set up, you have a bank account, and follow the law, you can do business.

So, you could become a private lender. Basically, instead of buying real estate yourself, you could be the ‘bank’ that lends on the deal. Investors are often looking for short term loans at a high interest rate to fund their deals.

If you know some investors, it may a good option for you.

Don’t Be Intimidated

Real estate investing is a big undertaking regardless if you are a US citizen or a foreign national.

You just need to know the steps, understand the risks, build the right team, and work hard at it. If you do all that you can achieve anything, including buying real estate in the US.

This article originally appeared on IdealREI. Follow them on Facebook, Instagram and Twitter.

You may like

Real Estate Investing

5 Recession-Proof Investments for Your Portfolio

Published

3 years agoon

May 3, 2023

By Sheryl Chapman

As we all know, the economy can be unpredictable at times. Recession is a common phenomenon that can affect the investments in your portfolio.

But don’t worry, there are some sectors that are likely to perform well—even during a recession. Here are five recession-proof investments that you can consider adding to your portfolio.

(Editor’s note***********:************ If you wanna learn how to start investing for retirement, check out the free lessons inside the academy! 📺)*

1. Consumer staples

Consumer staples are products that are essential to our daily lives, such as food, household goods, and personal care items.

These products are in constant demand, regardless of the economic climate. Companies that produce these items, such as Procter & Gamble and Coca-Cola, are considered recession-proof investments.

These companies have a stable revenue stream that can weather economic downturns.

2. Utilities

Utilities are another recession-resistant investment. People need electricity, gas, and water, regardless of the state of the economy.

Utility companies, such as Duke Energy and American Electric Power, have a steady stream of revenue and provide investors with a reliable source of income.

3. Healthcare

The healthcare industry is recession-proof because it provides essential services that people cannot do without. Companies that provide healthcare services or products, such as Johnson & Johnson and UnitedHealth Group, are likely to remain profitable during a recession.

4. Gold

Gold is a safe-haven investment that many investors turn to during times of economic uncertainty. Gold prices tend to rise during recessions because it is seen as a store of value. Investors can buy physical gold, gold ETFs, or invest in gold mining stocks.

GUIDE: 3 Ways To Invest In Gold In 3 Minutes Or Less 🔑📲

5. Treasury bonds

Treasury bonds are considered to be one of the safest investments during a recession.

These bonds are issued by the US government and are backed by the full faith and credit of the government. Treasury bonds provide a fixed income and are considered to be a low-risk investment.

In conclusion, these five investments are considered to be recession-proof because they provide essential products or services that people cannot do without.

Adding these investments to your portfolio can provide stability during times of economic uncertainty.

Real Estate Investing

5 Tips To Pricing Your Airbnb Listing For Maximum Profits

Published

3 years agoon

May 2, 2023

Airbnb has revolutionized the travel industry by providing an affordable and unique way for travelers to experience different destinations.

With over 7 million listings worldwide, it’s safe to say that Airbnb has become one of the most popular ways for travelers to find lodging.

However, as a host, one of the most challenging decisions you’ll face is determining the right price for your listing.

Pricing your Airbnb listing correctly is critical to your success as a host, as it can make or break your profitability.

Here are some tips to help you price your Airbnb listing for maximum profit:

Know Your Market

Before you set your price, it’s essential to research the market in your area. Look at other listings in your neighborhood, paying attention to the size of the property, amenities, and location. Check the availability of your competitors and the average price they charge. This information will help you determine your pricing strategy and ensure that your listing is competitive.

Consider Seasonal Demand

Seasonal demand plays a significant role in the pricing of your Airbnb listing. During peak seasons, such as holidays, festivals, and major events, you can charge higher rates. Conversely, during low seasons, you’ll need to lower your prices to attract guests. Keep track of events happening in your area and adjust your prices accordingly.

Offer Discounts

Offering discounts is an effective way to attract guests and increase your occupancy rate. Consider offering discounts for extended stays, early bookings, or last-minute reservations. You can also offer discounts to guests who leave a positive review or refer new guests to your listing.

Calculate Your Costs

To ensure that your pricing strategy is profitable, you need to calculate your costs. Take into account expenses such as cleaning fees, utilities, maintenance, and taxes. Factor in your time and effort as well. Your goal is to set a price that will cover all your costs while still allowing you to make a profit.

Be Flexible

Finally, be flexible with your pricing strategy. Test different prices and see how they affect your occupancy rate and profitability. Monitor your competition regularly and adjust your prices accordingly. Remember that the market is constantly changing, and your pricing strategy needs to adapt to stay competitive.

In conclusion, pricing your Airbnb listing for maximum profit is a crucial aspect of your success as a host. By researching your market, considering seasonal demand, offering discounts, calculating your costs, and being flexible, you can set the right price for your listing and maximize your profitability.

Happy hosting!

Real Estate Investing

5 Skyscrapers You Can Own Today With $5 Or Less

Published

3 years agoon

April 28, 20235 REITs that own iconic buildings you can buy today

Real Estate Investment Trusts (REITs) are companies that own and operate income-generating real estate properties.

Investing in REITs has become an increasingly popular way to own a piece of the real estate market without having to buy individual properties.

And you can buy them in the next 5 minutes on the NYCE app…with $5 or less.

Here are five REITs that own iconic buildings across the United States that you can invest in today:

- Empire State Realty Trust, Inc. (ESRT) – ESRT owns the famous Empire State Building in New York City, as well as several other properties in the city.

- Vornado Realty Trust (VNO) – VNO owns the iconic 555 California Street building in San Francisco, which was once the tallest building on the West Coast.

- Boston Properties, Inc. (BXP) – BXP owns several iconic buildings in the United States, including the John Hancock Tower in Boston and the Salesforce Tower in San Francisco.

- SL Green Realty Corp. (SLG) – SLG owns several iconic properties in New York City, including One Vanderbilt, which is currently the fourth-tallest building in the city.

- Macerich Company (MAC) – MAC owns several high-end shopping centers across the United States, including the iconic Santa Monica Place in California.

************************************************************************************************LEARN: How to own real estate with $1000 or less.

Investing in REITs can provide diversification and potentially higher returns than investing in individual properties. However, as with any investment, it is important to do your research and understand the risks involved.

Top 5 Best Investment Strategies To Survive A Recession

The Top 10 Investment Opportunities To Capitalize On During A Recession

3 Gold Mining Stocks To Buy Today 📲

Ad 1

Trending

You’ve reached your free article limit.

Continue reading by subscribing.

Already a subsciber? Login >

Go back to Homepage >

You must be logged in to post a comment Login