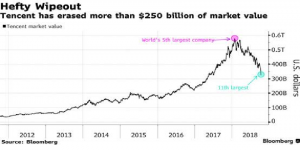

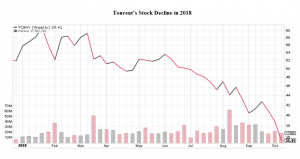

Tencent [TCEHY] investors have had a rough year so far as shares of China’s internet giant have declined close to 30% this year. The stock has declined due to the trade wars between China and the United States, declining margins and gaming regulations.

China is the biggest gaming market in the world and Tencent is the largest gaming company. So are these fears overblown? Have Tencent shares bottomed out? Is there significant upside potential for Tencent investors?

Gaming regulations

Chinese government departments approve video game licenses. However, certain departments are in a restructuring phase according to this Bloomberg report. This has led to a temporary freeze in gaming approvals.

The report states that while the National Radio and TV Administration has not issued licenses for 4 months now, the Ministry of Culture and Tourism has made registering games difficult.

Government interference and regulations are a part and parcel of the Chinese markets. There is always a potential risk of uncertainty for investors here. Tencent is yet to receive the necessary approvals for the new genre of gaming that has taken the world by storm – the battle royale.

Games such as Fortnite and PUBG have gained immense popularity and impacted stocks of top gaming companies such as Activision Blizzard [ATVI] and Electronic Arts [EA]. Further, Tencent was asked to recall one of its highly anticipated games – Monster Hunter: World just a few days after it debuted.

The game was pulled out after people raised objections to its content. Tencent is not concerned over this delay and expects the regulatory issues to be resolved quickly.

Trade war fears

The ongoing trade wars between China and the United States have driven several Chinese and domestic stocks lower. The two governments have been battling out since the start of 2018 and this is unlikely to abate in the near future.

However, such a reaction to the trade wars does not make sense, especially for Tencent as it generates almost 96% of revenue from domestic markets.

Declining margins

In Q2 2018, Tencent’s operating profits rose 11% year-over-year driven by a 30% rise in sales. However, the company’s operating margin fell to 30% from 35%. Profit margins were impacted due to the ongoing gaming ban. Tencent is unable to monetize two of its key video games.

The Chinese government is also increasing regulations on digital payment products.

Is Tencent’s growth story over?

The answer is NO. Despite these headwinds analysts expect Tencent’s sales to rise 29% to a whopping $78B in 2020. Tencent also owns China’s most popular messaging app known as WeChat. This is similar to WhatsApp and has over a billion users.

Its growing ecosystem of Mini Programs (these are apps that are a part of the core application) makes the WeChat platform more powerful. Mini-programs include a scan-to-buy function used by retailers, a pre-ordering restaurant app and a transport payment solution.

WeChat also has a digital payment system known as WeChat Pay and can be accessed by third-party apps as well as physical retail stores.

Once the regulatory issues are sorted, Tencent shares will continue to move higher driven by a growing gaming market. Don’t forget Tencent has generated absolute returns of a monstrous 34000% since 2004.

You must be logged in to post a comment Login