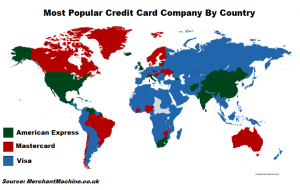

In our third edition of the Battle Of The Stocks, we size up two payment processing giants: Visa [V] and Mastercard [MA]. These behemoths account for a majority of the payment processing market share in the United States.

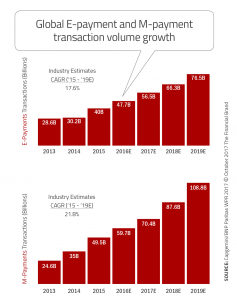

At the end of Q1 2018, Visa was the undisputed domestic leader with a share of 53% followed by Mastercard and American Express [AXP] at 22% each. Visa and Mastercard have benefitted to a large extent driven by the exponential growth in electronic payments.

But historical gains are not an indicator of future performance. Let us look at the key financial metrics between the two companies and compare them to see which is a better buy at current levels.

Market Cap

Driven by the massive increase in share prices, the market cap or market value of Mastercard and Visa have gained significantly over the last few years.

Shares of Visa have risen 220% over the last years and is up 32% in 2018. Comparatively, the Mastercard stock has gained 233% in the last years and 48% in 2018.

Mastercard’s market cap is currently $230.83B while Visa’s market cap is higher at $333B.

Revenue Growth

Revenue growth is a key indicator to gauge the financial position of any company. Any firm that can grow its revenue will be worth investing in. Visa reported sales of 18.36B in 2017. Analysts expect Visa’s revenue to grow 12.2% to $20.6B in 2018 and 11.4% to 23B in 2019.

Mastercard reported sales of $14.95B in 2017. According to analysts, the company is estimated to grow sales by 19.6% in 2018 and 12.9% in 2019.

WINNER: Mastercard

Profitability

The profit margins of payment processing companies are generally high and way above other sectors. The high gross margin translates into robust bottom-lines for companies.

Visa’s operating margin is expected to be 66.5% in 2018 and 68.6% in 2019. Mastercard’s estimated profit margin is lower at 55.8% this year and 57.1% in 2019.

Visa’s estimated net margin is close to 50% in 2018 and 52.3% in 2019. Mastercard, on the other hand, is expected to post a net margin of 43.3% in 2018 and 45% in 2019.

WINNER: Visa

Earnings Growth

While the two companies are looking to improve profit margins, analysts and investors are concerned over the earnings growth potential.

Analysts expect Visa’s earnings per share (or EPS) to grow at 32% in 2018 and 19.1% over the next five years. Comparatively, analysts expect Mastercard’s earnings to rise 40% this year and 22.6% over the next five years.

WINNER: Mastercard

Analyst estimates

We have looked at key financial metrics for the two stocks. Let us now see what Wall Street analysts expect from the two companies. Analysts have a 12-month average target price of $162.18 for Visa, indicating an upside potential of 8.4%.

Comparatively, analysts expect Mastercard’s share price to rise to $231.51, providing an upside potential of 4.1% over the next year.

WINNER: Visa

The scorecard is tied at 2-2. However, we believe that the electronic payments will continue to experience significant growth driven by emerging markets. Mastercard has historically been able to take advantage of foreign opportunities as compared to Visa.

Mastercard also generates substantial fee income from cross-border activities and just pips Visa in this close race. Mastercard was recently added to Goldman Sachs’ [GS] conviction list.

Wealthlab Verdict: Mastercard

You must be logged in to post a comment Login