There are many investment vehicles to choose from, such as stock and bonds, real estate, VUL insurance, mutual funds, and many others. For a lot of people, creating an effective investment strategy can be overwhelming. Some want quick returns and forget that there’s a lifetime ahead of them to make their investments and other resources work for them, while others are content with having bank accounts that earn little to no profit.

But when it comes to investments, it’s not about which one you should put your money in – it’s about which investment vehicles are right for your individual financial situation and goals.

Before Investing: Factors to Consider

The key to becoming a smart investor is to match your resources, requirements, and priorities in relation to a particular period or stage in your life. This means your investment decisions will have to be based on several factors, including your monthly income, assets, expenses, financial goals, and risk appetite for investment, among others.

Since investing can take a considerable chunk of your finances, you need to check your cash flow. Do you have a regular office job or a flourishing business that gives you a stable source of income? With the income you’re getting, are you still left with surplus cash that you can use toward investing? It’s important to ask these questions as these allow you to set proper expectations about your financial responsibility as an investor.

It’s also advisable for you to take stock of your financial position for the short term. Ideally, you should have saved six months’ worth of salary to help you minimize the impact for when your ability to earn – and consequently, invest – is affected by economic factors or personal emergencies. It simply isn’t wise to go into investments when you’re struggling with your finances, especially when there’s no real guarantee that your return on investment (ROI) is going to be quick. The idea in investing is to part with money, which you can afford not to use or spend for months or years.

Your readiness to invest may also depend on how much you’re paying your billers to cover for your monthly expenses, such as housing, education, transportation, food or groceries, and the like. Aside from these, you have to factor in your lifestyle and personal expenses, too. If you’re spending more than what you’re earning, it’s a red flag indicating that you don’t have a healthy financial status and may not be ready to invest.

Here’s a sample of the recommended expense-to-income ratio for various types of expenses:

Housing: 20% to 25% of your income

Transportation: 15% to 25% of your income

Living Allowance: 20% to 25 of your income

Debt Payments: 5% to 10% of your income

Savings: 10% to 15% of your income

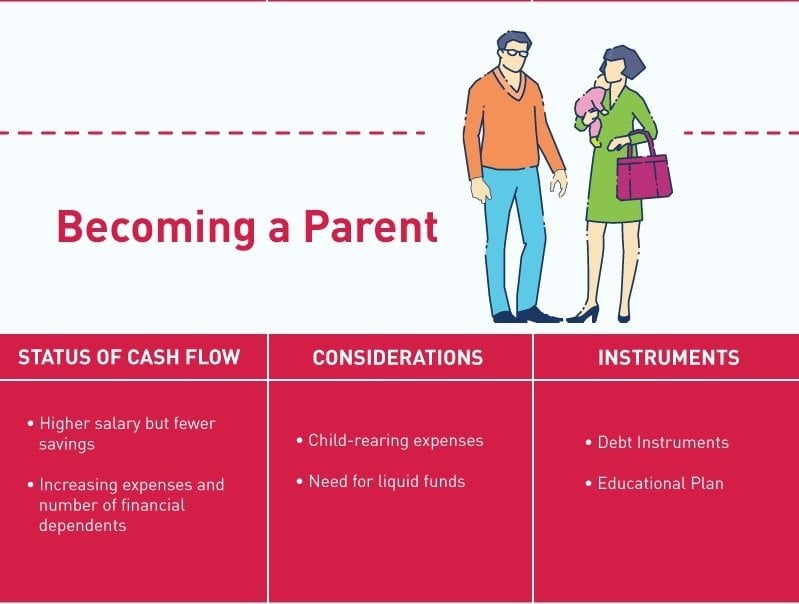

When it comes to your financial goals, you can tap on your investments to help you reach those objectives. If you’re a new parent, some of your high-priority goals may be to buy a house, establish your child’s educational fund, and make sure you have readily-available cash in your bank account.

In this case, you’d do well to put your assets in different investment vehicles. Doing so helps you manage the risks that come with investing, and as a result, gives you more chances of achieving your goals as the money you invested starts growing.

Speaking of risks, it’s another factor you need to consider when you decide to invest. Since almost all forms of investment come with a risk, you need to determine if you’re open to the prospect of having your investments depreciate at some point in time. This is known as your risk appetite. If you’re not too comfortable with the thought of incurring possible losses, then you’ll have to be conservative in investing. Consider investments with lesser risk.

Your timeframe for investment vehicles may also influence how much risk you’re willing to take. Generally speaking, your risk appetite decreases as you age. If you start building your investment portfolio while you’re in your 20s, you can have more time to recover any money you might lose than if you choose to invest when you’re already nearing retirement.

Which investment vehicles Should You Invest In?

Once you’ve assessed the various factors described above, the next step is choosing the right investment vehicle. This is one of the biggest dilemmas that investors tackle, especially if you’re barely getting started. You might find the decision process easier if you first line up your goals, and from there, make a comparison of what investment vehicles might be suitable for your timeline.

It’s likely that you’ll be coming up with short-, medium-, and long-term goals. Naturally, each of these will require investments that are aligned with yet a different set of factors, such as interest rates, liquidity period, and overall value for your hard-earned money.

For short-term goals, the most common types of investment may include fixed deposit, liquid funds, or short-term debt funds. Meanwhile, you may opt for balanced funds and equity-linked savings schemes for your medium-term goals. Obviously, your long-term goals will give you the widest range of options, from stocks and bonds to real estate.

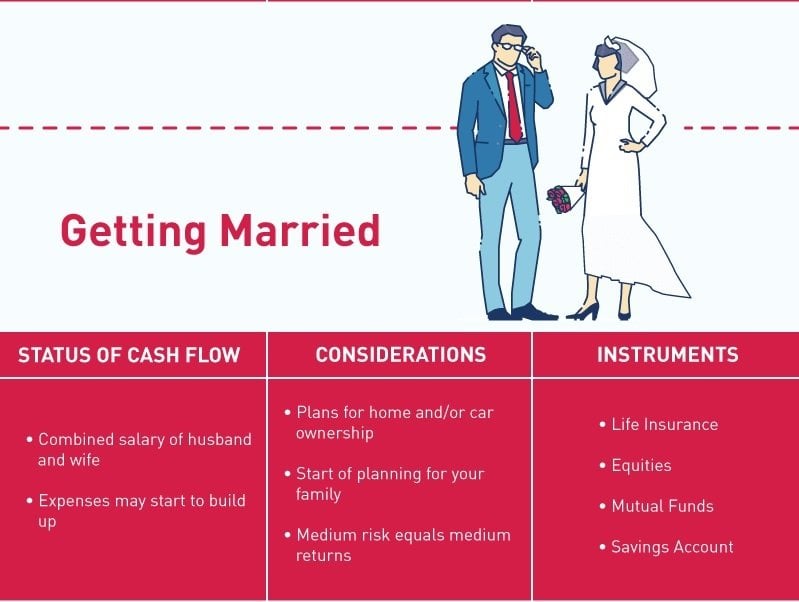

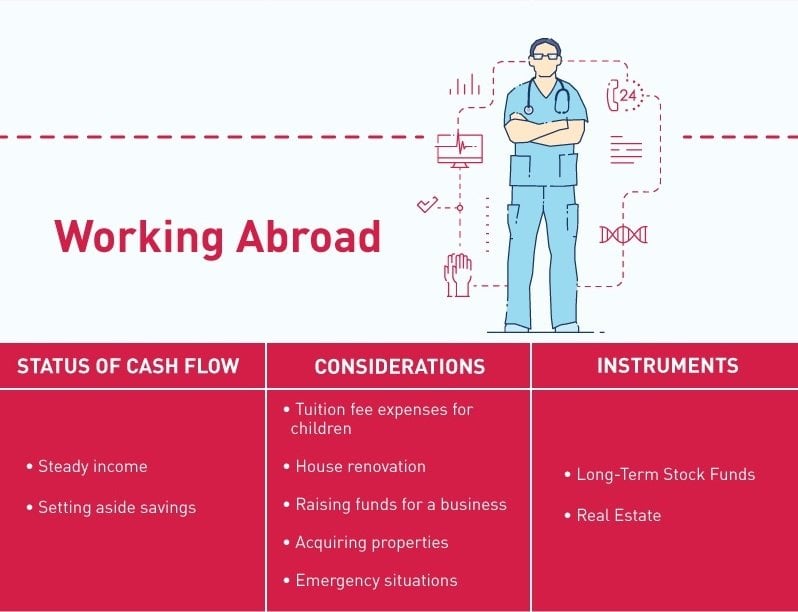

Indeed, investing your hard-earned dollars is a major venture that requires a lot of homework, careful planning, making projections, weighing your options, and so on, to grow your money over time. In our featured infographic, we discuss more of the things you need to consider, so you can have a clearer perspective about investing at whatever life stage you may be.

You must be logged in to post a comment Login