It’s a buzzword we hear constantly—and one that’s sure to generate tons of headlines. Alibaba had the largest in history (before its billionaire founder decided he wanted to quit to be a grade school teacher.)

Lyft IPO’d recently also, beating arch rival Uber to the proverbial punch.

Other than being a buzzword and a big story, what exactly is an IPO?! Well, let’s break it down.

What is an IPO?!

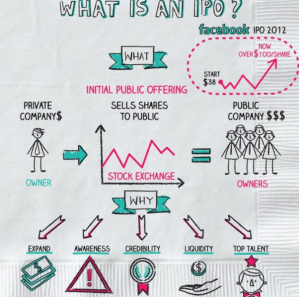

In technical terms, an Initial Public Offering (IPO) is the first sale of stock issued by a company to the public. In other words, this is the moment when a private company goes “public” by offering its shares for sale to the public.

So when a company does go public, the valuation usually spikes dramatically—and the company can now use the funds from the sale of shares to feed the business. It’s a fabulous funding source for a company.

Before that, what is a company?

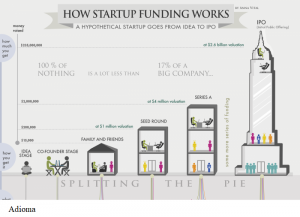

Prior to going public, a company is a privately-owned firm. Obviously. The company initially attracts investments or seed capital from the co-founder, friends, and families.

Business investors such as venture capitalists, private equity companies and angel investors pump in money if they are optimistic about long-term prospects and sustainability of the company.

On the flip side of things, you sometimes have companies that decide to go “private,” like Elon Musk said he wanted to do with Tesla.

Why does a company opt for an IPO?

The biggest advantage for a publicly listed company is access to capital. This capital can be used to purchase machinery, fund research and development or pay off any existing debt.

The firm will then be listed on a public exchange and provides an exit route for business investors and founders.

When Facebook went public, Mark Zuckerberg sold 30M shares worth $1.1B. An IPO is the most common way for investors and VCs to make a significant return on their investment. In fact, it’s considered the ultimate exit for founders.

How much capital do the companies get?

Let’s run down the list.

Alibaba [BABA] raised $25B in an IPO back in Sept. 2014. Facebook [FB] raised $16B in May 2012. Visa [V] raised $7.9B in March 2008.

Top tech unicorns such as Uber, Slack, and Airbnb are on course to file for an IPO over the next 18 months.

The company that is looking to go public hires an investment bank to underwriting the IPO process. Investment banks can either work together or individually in this process.

What do the investment bankers do?

In other words, all the boring admin stuff. In exchange for this, they collect a nice fat fee, usually anywhere from 4-7% of gross proceeds.

Those involved hold several meetings to finalize the IPO process and determine the timing of the filing. Once this is wrapped up, they shift to performing the due diligence to ensure the company’s registration statements are accurate.

The due diligence tasks include market due diligence, legal and IP due diligence, financial and tax due diligence. At the end of this process, the companies then file for an S-1 Registration Statement.

The S-1 is usually what tips off the press and the public that a company is about to go, well, public.

And what’s the S-1?

The S-1 statement includes information about the companies’ historical financial statements, company overview, risk factors, and other critical data.

A pre-IPO analyst meeting is then held post the S-1 Registration Statement to educate analysts and bankers about the company.

Confused yet?

A preliminary prospectus can also be drafted at this stage. The underwriting investment bank conducts pre-marketing to determine the interest of institutional investors and the price they are willing to pay per share.

Now you’re ready to go public

The price range for an IPO is set and the S-1 Registration Statement is amended with the price range. The company’s management organizes road shows and marketing activities to generate interest for the upcoming IPO.

Based on investor interest, the price range per share can be revised. The investors will apply for company shares and this application window is open for generally 2-4 days. The company shares can be oversubscribed or undersubscribed.

Once the IPO is priced, the investment banks will allocate shares to investors where the stock will now be available for trading in the secondary market.

At this point, a company is now ready to go public. Here’s how people usually look when that happens.

SNAP executives during happier days.

Congrats. You’re now an IPO expert.