The week of Thanksgiving has become one of the most anticipated shopping periods of the year, with analysts projecting up to $60B in sales today—Black Friday—alone.

While retailers slash product prices, they try to compete and outdo each other by offering the best Black Friday or Cyber Monday deals.

Consumers, on the other hand, are on the lookout for the best bargains available and are willing participants in this shopping spree.

This year’s Thanksgiving week will shatter records

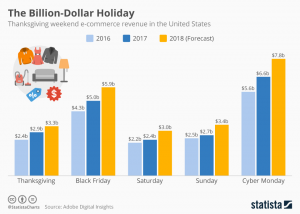

According to Statista, Thanksgiving week was projected to hit record sales in the US.

Overall, Statista projected Thanksgiving day sales to rise close to 14% to $3.3B. Black Friday and Cyber Monday were expected to soar by 18%, with an overall estimate of $23.4B in total sales.

Turns out sales will eclipse that today.

“Black Friday is bigger than a 24-hour shopping sprint or even a week-long marathon,” Accenture Strategy’s Frank Layo told Business Insider this morning. “It’s turned into a month-long extravaganza which started with promotions just after Halloween, and will continue well after Cyber Monday.”

Peak holiday season

While the holiday season in the United States begins in late October, it peaks during the second half of November. We can see above when US consumers expect to do holiday shopping is the highest in late November at 72%. This time coincides with Thanksgiving week.

According to Deloitte’s report, holiday shoppers will spend an average of $1,536 in the holiday season of 2018 with gifts accounting for $525 of the total amount spent.

In the Thanksgiving week of 2017, shares of Amazon [AMZN] touched a then all-time high of $1,195.83 and propelled CEO Jeff Bezos’ net worth into the untouched $100B dollar territory.

It will be interesting to see if Amazon shares recover following record sales. The stock has been pummeled in the recent past and has lost over 24% in market value since October 2018.

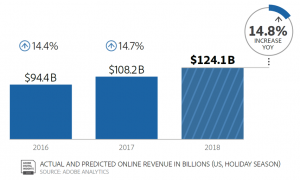

Total holiday spending might cross $124B this season

According to market research firm ADI, consumers might spend a whopping $124B this holiday season, up from $108.2B last year. Taylor Schreiner, principal analyst at ADI stated, “This consistent growth is itself a surprise. To have a $100B industry continue to grow in double digits is unusual and impressive.”

This holiday season is set to be a blockbuster one for online and physical retailers. Watch this space as we will shortly analyze the impact of strong holiday sales on the stock prices of retail companies.

You must be logged in to post a comment Login